Bitcoin rose as excessive as $47,583 on Monday effectively above the $35,000-to-$45,000 band the place it’s been caught since January.

Bitcoin broke out of a slim buying and selling vary and wiped away this yr’s losses amid a broad rally for cryptocurrencies, sparking hypothesis that the largest digital asset might advance previous the $50,000 mark quickly.

The token rose as excessive as $47,583 on Monday, effectively above the $35,000-to-$45,000 band the place it’s been caught since early January. With the contemporary features, Bitcoin is now up about 1.9% for the yr, in contrast with a 4.7% decline for the S&P 500. Ether equally bounced as a lot as 3.7% to $3,358 on Monday, whereas altcoins comparable to Solana’s SOL, Avalanche’s AAVE and Dogecoin rose between 5.5% and 9.4%.

Bitcoin might encounter its subsequent resistance degree at $52,000 and may it break via that, it might advance to $65,000 — not far off the all-time excessive it reached in November, in line with Fadi Aboualfa, head of analysis at Copper. Rick Bensignor, the president of Bensignor Funding Methods, mentioned in a be aware Sunday that Bitcoin is “on the verge of a 20% run increased.”

The coin has been caught in a decent path because the Federal Reserve and different central banks take away a number of the stimulus measures they put in place in response to the pandemic downturn. Which means there’s much less money to go towards riskier property, together with crypto. As well as, digital currencies got here beneath scrutiny with hypothesis swirling that they could possibly be used to skirt Russian sanctions, although many analysts rebuff that declare.

Even so, Bitcoin and different tokens like Ether began a gradual advance this month alongside broader will increase in U.S. shares. Nevertheless it took till the previous day for Bitcoin to convincingly take out $45,000, a degree it had solely briefly touched since early January.

“As we take a look at the highest of the 2022 buying and selling vary for the fifth time, that is one other considered one of these Bitcoin moments when the narrative might swiftly change and traders pile in, propelling the Bitcoin worth increased,” mentioned Antoni Trenchev, co-founder and managing associate at Nexo. “It would simply be time to awaken from the Bitcoin-sideways slumber that’s been 2022.”

The renewed optimism for cryptocurrencies adopted feedback by U.S. Treasury Secretary Janet Yellen, who mentioned in a March 25 interview with CNBC that regardless of her personal skepticism in regards to the asset class, “there are advantages from crypto and we acknowledge that innovation within the fee system could be a wholesome factor”. Hypothesis on social media additionally recommended buying and selling was being supported by whale exercise from the Luna Basis Guard, an open-source group targeted on the Terra blockchain, which mentioned it plans to again the community’s token with greater than $10 billion in Bitcoin reserves.

‘Overbought’ Vary

Bitcoin was effectively above its 50-day transferring common in current days, which presently sits round $41,085. That places it across the eightieth to ninetieth percentile and within the “overbought” vary, in line with Bespoke Funding Group. However, although that indicators potential for a downturn in worth for a lot of property, with Bitcoin it’s traditionally been the other, the agency mentioned

“When it has been equally overbought in its previous (during the last 5 years), it has averaged important features going out one to 12 months,” in line with the Bespoke report.

When Bitcoin has been within the ninth decile of its unfold versus its 50-day common, it’s traditionally risen 16% within the subsequent month, is up 100% six months later, and has gained 274% after a yr, in line with knowledge compiled by Bespoke.

“This isn’t usually what you see for the everyday inventory or ETF, however as a result of Bitcoin has largely traded increased through the years and actually has lots of momentum buying and selling behind it, overbought ranges have but to turn into a headwind for this specific house,” Bespoke wrote.

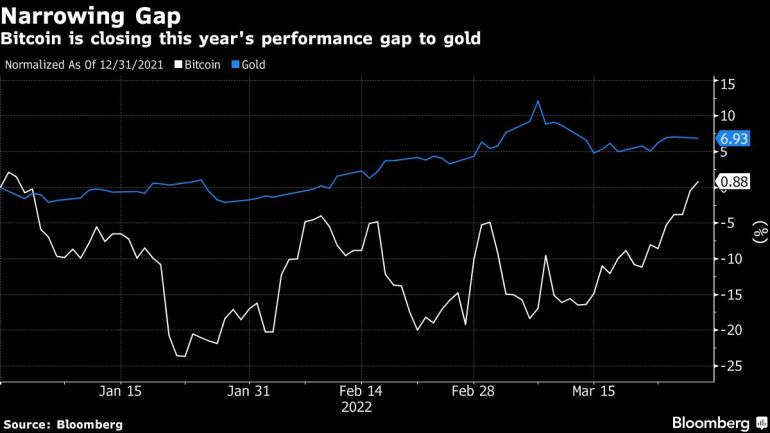

Bitcon’s features since mid-March — whilst Russia’s conflict in Ukraine dragged on — on additionally bolstered it versus gold, its conventional safe-haven rival, which traded sideways through the interval.

(Updates with pricing knowledge and context within the second and seventh paragraphs.)

Post a Comment