Rising meals costs will be vastly destabilizing.

Whereas vitality costs are an ongoing danger to inflation in international locations world wide, a number of emerging-market international locations face a distinct downside: The tempo of meals value inflation is rendering their currencies weak.

The UN’s February World Meals Worth Index, launched on Friday, was primarily unchanged at 20.7% y/y vs 19.2% in January, maybe surprisingly given the rampant rally in smooth commodity costs similar to corn and wheat. However inflation measures usually are severely lagging indicators, and the index ought to quickly begin to mirror latest rallies in smooth commodity costs.

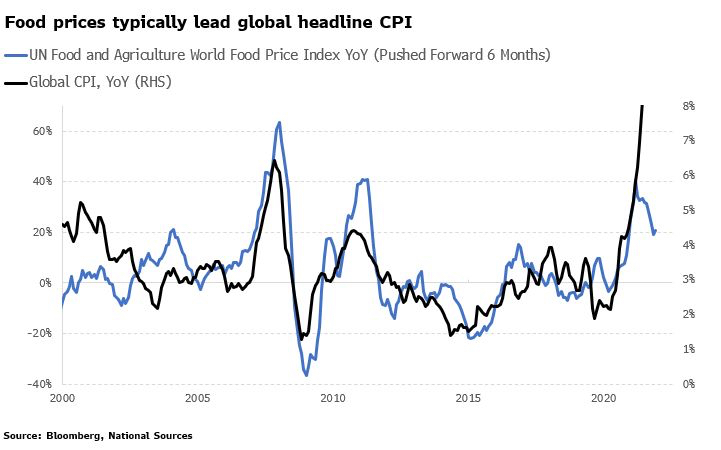

Monday’s acceleration in vitality costs poses an extra danger to meals costs, given oil is a key element in fertilizers. Moreover, meals costs usually lead international headline inflation. The chart beneath reveals that as issues stand, international CPI ought to ease over the subsequent three to 9 months, however there are upside dangers to this if vitality costs stay elevated.

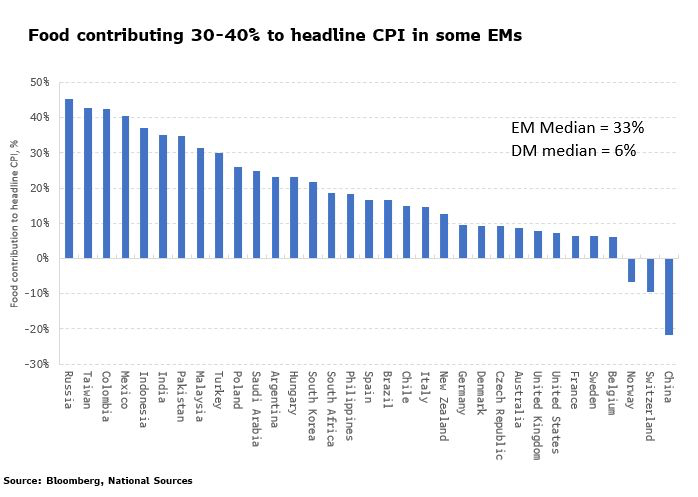

Nonetheless, international CPI masks some huge underlying divergences, with emerging-market inflation – already rising a lot quicker than developed-market inflation – acutely uncovered to rising meals costs.

It is because meals represents a far bigger proportion of headline CPI baskets in EM in comparison with DM international locations. Meals makes up nearly half of India’s CPI basket, and over 30% of it within the Philippines, China and Russia, whereas in European international locations it's round 10-15%, and within the U.S. it is just round 8%.

As was seen within the Arab Spring within the early 2010s, rising meals costs will be vastly destabilizing. The impression they're having on broader inflation is rising and subsequently the danger they pose to EM governments is mounting. For the median EM nation, meals is nearly a 3rd of present year-on-year headline CPI. In Russia, nearly half of the present 8.7level of CPI is coming from meals, whereas within the US, UK and far of Europe meals is just 10% or much less of headline CPI presently.

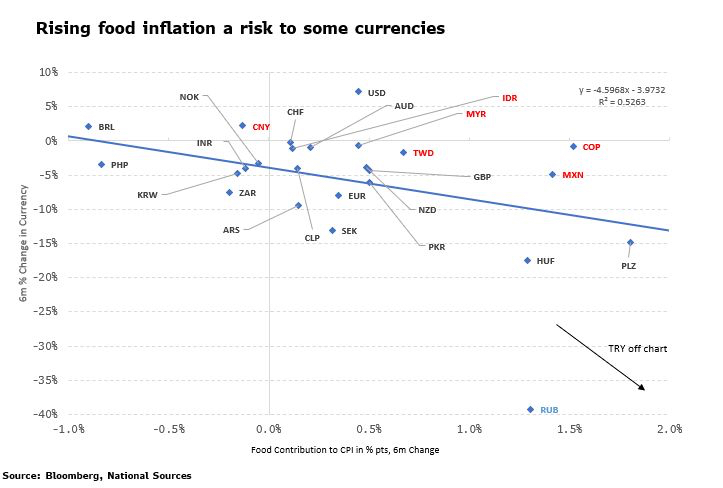

Meals inflation presents a danger to currencies. We will plot the six-month change in meals CPI’s contribution to the headline vs the six-month change within the foreign money for every nation. We will see from the chart beneath the Taiwanese greenback, Mexican peso, the Colombian peso, the ringgit, the rupiah and the yuan all look weak amongst EM currencies given the rise in meals costs. Turkey is actually off the chart with meals including an additional 8.5% factors to CPI during the last six months, whereas Russia’s foreign money has already collapsed attributable to sanctions.

And as currencies weaken, the danger of an inflation spiral in EMs rises as the price of imported items climbs much more.

NOTE: This was a put up on Bloomberg’s Markets Stay weblog. The observations are these of the blogger and never meant as funding recommendation. For extra markets evaluation, go to MLIV.

Post a Comment