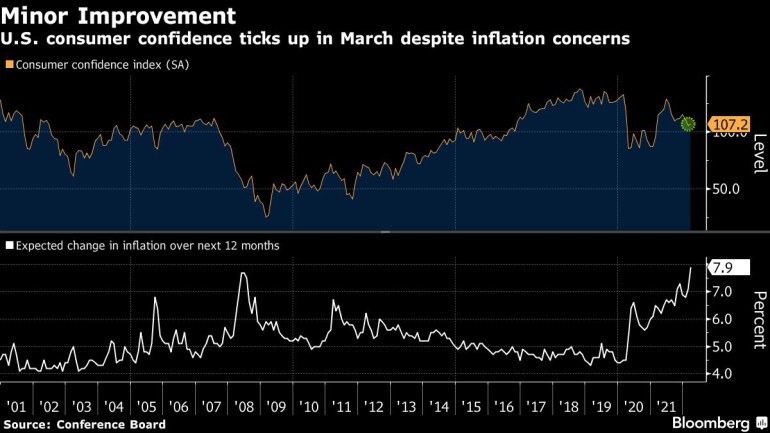

U.S. client confidence unexpectedly edged up in March, suggesting strong job progress offset Individuals’ issues over decades-high inflation that poses a threat to spending and progress.

The Convention Board’s index elevated to 107.2 from a downwardly revised 105.7 studying in February, which was the bottom in a yr, based on the group’s report Tuesday. The median forecast in a Bloomberg survey of economists known as for a studying of 107.

Regardless that confidence edged increased, Individuals are going through the best inflation since 1982, which is outpacing wage positive factors and being fanned additional by the conflict in Ukraine. That’s already inflicting some to restrict their purchases of sure items or companies, and a slowdown in consumption would pose a threat to financial progress.

Inflation-adjusted spending information for February will likely be launched Thursday.

Nonetheless, regular labor market positive factors have pushed employment again to pre-pandemic ranges in some sectors, buoying U.S. households. The economic system in all probability added near a half million jobs in March because the unemployment charge fell to three.7%, based on the median projections in a Bloomberg survey forward of presidency information Friday.

The share of shoppers who stated jobs had been “plentiful” elevated to a document excessive 57.2%. A separate report Tuesday confirmed U.S. job openings remained close to a document in February.

Shoppers had been additionally blended about their short-term monetary prospects. The share who anticipate their incomes to rise within the subsequent six months elevated, however those that see their pay dropping additionally rose.

A gauge of present situations rose by probably the most since June to 153, suggesting shoppers had a extra upbeat evaluation of enterprise situations and the labor market. The Convention Board’s expectations index — which displays shoppers’ six-month outlook — declined to 76.6, the bottom since 2014.

Issues over inflation intensified in March, the report confirmed. Shoppers anticipate costs to rise 7.9% within the subsequent yr, an all-time excessive.

The share anticipating to purchase a brand new automobile fell to 9.3% from 10.7%.

A measure of dwelling shopping for situations held on the lowest since November. Mortgage charges have shortly surged to the best degree in over three years because the Federal Reserve tightens financial coverage to rein in spiraling costs, pushing homeownership out of attain for a lot of aspiring patrons.

“These headwinds are anticipated to persist within the quick time period and should doubtlessly dampen confidence in addition to cool spending additional within the months forward,” Lynn Franco, senior director of financial indicators on the Convention Board, stated in an announcement.

Post a Comment