A rout in Chinese language expertise shares additionally weighed on sentiment over renewed regulatory dangers and considerations about Beijing’s shut relationship with Russia.

U.S. equities wavered on Monday as world tensions with Russia continued to escalate amid key diplomatic discussions.

The S&P 500 index was little modified and the Nasdaq 100 fell as negotiations between Russia and Ukraine entered a fourth spherical, with the Kremlin saying it might “understand all its plans” in its invasion of Ukraine.

A rout in Chinese language expertise shares additionally weighed on sentiment over renewed regulatory dangers and considerations about Beijing’s shut relationship with Russia. High officers from the U.S. and China began talks on Monday within the first high-level, in-person discussions because the conflict started.

Some giant U.S. tech names together with Apple Inc. had been buying and selling decrease. In the meantime, a drop in crude oil dragged on shares of power firms.

The U.S. Federal Reserve on Wednesday is anticipated to start a cycle of fee will increase, beginning with a 25 basis-points transfer. Value pressures had been already excessive earlier than the Ukraine conflict and the isolation of resource-rich Russia upended commodity flows.

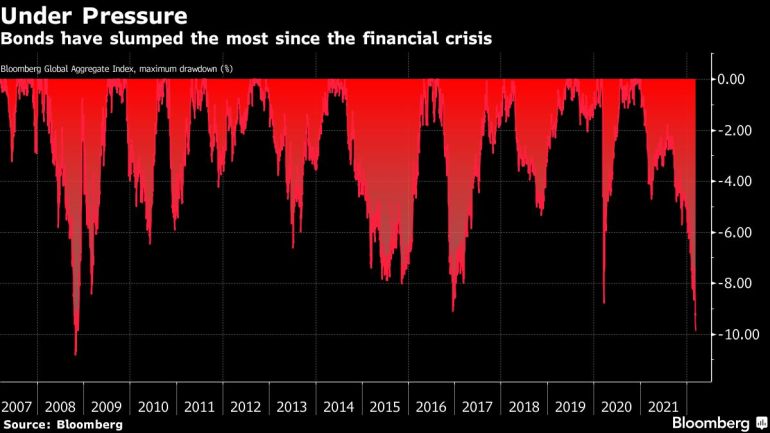

The ten-year Treasury yield climbed to its highest degree since July 2019, whereas the five-year measure crested 2% for the primary time in three years.

“We're experiencing extraordinary volatility in world equities compounded by wavering market sentiment, and the danger of recession intensifies on spiraling commodity costs,” Louise Dudley, portfolio supervisor for world equities at Federated Hermes, wrote in a notice. “We count on ongoing swings within the brief time period as geopolitical uncertainty over Russian crude persists.”

The Stoxx Europe 600 index jumped greater than 1% earlier than paring the achieve. Carmakers outperformed following a “assured” outlook from Volkswagen AG. Fundamental-resources and power shares fell. Tech investor Prosus NV slumped 10%.

The 11% plunge in a gauge of Chinese language tech corporations reverberated across the area, leaving an Asia-Pacific fairness index within the pink for a second session. Whilst China denied it’s been requested for navy help, merchants fear that Beijing’s potential overture towards Vladimir Putin might carry a world backlash towards Chinese language corporations, even sanctions. Sentiment was additionally damage by a Covid-induced lockdown within the southern metropolis of Shenzhen, a key tech hub, and the northern province of Jilin.

Whereas the U.S. and another nations are tightening financial settings, hypothesis is rising that China will introduce extra easing to alleviate a slowdown. In the meantime, the Fed is the drawcard amongst eight Group-of-20 members whose financial officers are due this week to evaluate financial prospects.

“The Fed assembly this Wednesday is necessary in that it marks the top of this cycle’s ultra-easy coverage and the beginning of tightening, however additionally it is necessary as a result of Jay Powell has a chance to start out speaking in regards to the Fed’s expectations for the financial fallout from the battle and plans to navigate it,” wrote Chris Low, chief economist at FHN Monetary.

WTI crude dropped under $104 a barrel. The greenback edged decrease and gold retreated. Elsewhere, the ruble strengthened about 3% versus the buck in Moscow buying and selling, with Russia’s inventory market nonetheless closed. Buyers are ready to see if Russia defaults on its worldwide debt after dropping entry to nearly half of its foreign-exchange reserves.

Listed here are some key occasions to observe this week:

- China one-year medium-term lending facility fee, financial exercise information, Tuesday

- EIA crude oil stock report, WednesdayFOMC fee determination and Fed Chair Jerome Powell information convention, Wednesday

- Financial institution of England fee determination, Thursday

- ECB President Christine Lagarde, Government Board member Isabel Schnabel, Governing Council member Ignazio Visco and Chief Economist Philip Lane communicate at a convention, Thursday

- Financial institution of Japan fee determination, Friday

A number of the most important strikes in markets:

Shares

- The S&P 500 had been little modified as of 9:40 a.m. New York time

- The Nasdaq 100 fell 0.7%

- The Dow Jones Industrial Common was little modified

- The Stoxx Europe 600 rose 0.9%

- The MSCI World index fell 0.3%

Currencies

- The Bloomberg Greenback Spot Index was little modified

- The euro rose 0.3% to $1.0943

- The British pound rose 0.1% to $1.3053

- The Japanese yen fell 0.6% to 117.97 per greenback

Bonds

- The yield on 10-year

- Treasuries superior 9 foundation factors to 2.08%

- Germany’s 10-year yield superior 9 foundation factors to 0.34%

- Britain’s 10-year yield superior 9 foundation factors to 1.58%

Commodities

- West Texas Intermediate crude fell 5.7% to $103.12 a barrel

- Gold futures fell 0.9% to $1,966.20 an oz

–With help from Greg Ritchie and Andreea Papuc.

Post a Comment