The US central financial institution final month forecast not less than six extra will increase for the remainder of this yr to curb the most popular inflation in 4 many years.

Federal Reserve Governor Lael Brainard known as the duty of lowering inflation pressures “paramount” and mentioned the central financial institution will increase rates of interest steadily whereas beginning stability sheet discount as quickly as subsequent month.

The Federal Open Market Committee “will proceed tightening financial coverage methodically by a sequence of rate of interest will increase and by beginning to cut back the stability sheet at a fast tempo as quickly as our Could assembly,” Brainard mentioned on Tuesday in remarks ready for a speech to the Minneapolis Fed.

“On condition that the restoration has been significantly stronger and quicker than within the earlier cycle, I count on the stability sheet to shrink significantly extra quickly than within the earlier restoration, with considerably bigger caps and a a lot shorter interval to section within the most caps in contrast with 2017–19,” she added. Officers subsequent meet Could 3-4.

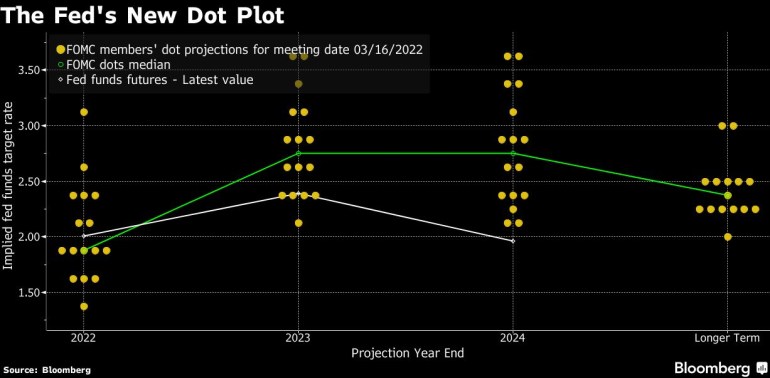

The U.S. central financial institution ended asset purchases final month and raised rates of interest 1 / 4 share level, whereas forecasting not less than six extra will increase for the remainder of this yr to curb the most popular inflation in 4 many years. Brainard’s feedback raised the importance of asset runoff to the FOMC’s sense of total tightening.

“The discount within the stability sheet will contribute to financial coverage tightening over and above the anticipated will increase within the coverage charge mirrored in market pricing and the committee’s Abstract of Financial Projections,” she mentioned, referring to the Fed’s quarterly forecasts.

Brainard, who's awaiting Senate affirmation to turn out to be Fed vice chair, mentioned Russia’s invasion of Ukraine is a “seismic” geopolitical danger and human tragedy that skews inflation danger to the upside.

The patron worth index soared 7.9% in February, probably the most since 1982. The Fed’s 2% inflation goal relies on a separate measure, the private consumption expenditures worth index, which rose 6.4% within the 12 months by February.

She spent a lot of her remarks describing how inflation has various impacts throughout earnings brackets, with lower-earning households spending 77% of their earnings on requirements versus 31% for higher-income households.

Brainard’s coverage feedback counsel she is someplace close to the median estimate of seven charge will increase this yr, but in addition ready to go quicker if inflation doesn’t subside.

“At the moment, inflation is far too excessive and is topic to upside dangers,” she mentioned. “The committee is ready to take stronger motion if indicators of inflation and inflation expectations point out that such motion is warranted.”

“On the opposite facet, I'm attentive to alerts from the yield curve at totally different horizons and from different information that may counsel elevated draw back dangers to exercise,” she mentioned.

Traders guess that the Fed will increase charges by a half level at its Could assembly. Brainard didn't make it clear the place she stood on that time and was not requested straight about it in the course of the moderated question-and-answer session that adopted her ready remarks.

However Kansas Metropolis Fed President Esther George mentioned a half-point enhance can be on the desk when coverage makers meet subsequent month.

“I believe that fifty foundation factors goes to be an choice that we’ll have to contemplate,” she mentioned in a Bloomberg Tv interview with Michael McKee. “We've to be very deliberate and intentional as we take away this lodging.”

(Updates with feedback by Fed’s George in last paragraph.)

Post a Comment