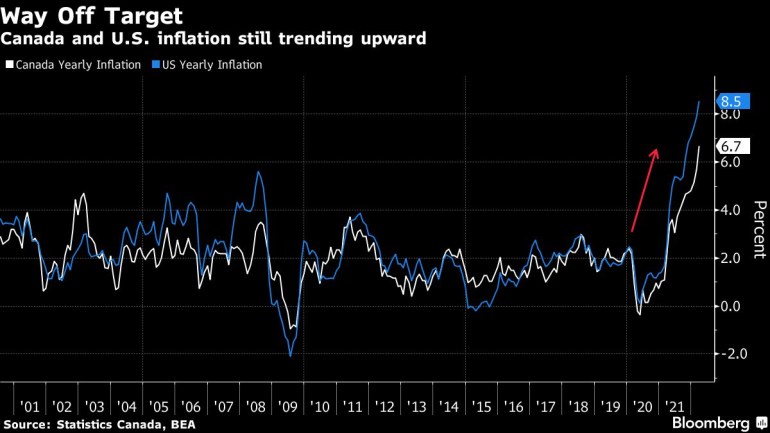

Annual inflation rose to six.7 p.c final month, up from 5.7 p.c in February, Statistics Canada reported Wednesday.

Canadian shopper worth inflation shot previous expectations in March, leaping to a brand new three-decade excessive and cementing expectations the Financial institution of Canada will proceed with aggressive rate of interest hikes in coming weeks.

Annual inflation rose to six.7% final month, up from 5.7% in February, Statistics Canada reported Wednesday in Ottawa. That’s the best since January 1991 and exceeds the median estimate of 6.1% in a Bloomberg survey of economists.

The report exhibits inflation pressures which can be extra elevated than the central financial institution estimated simply final week, reinforcing strain on policymakers led by Governor Tiff Macklem to withdraw stimulus from an overheating financial system. Buyers see robust likelihood of a second half-percentage level enhance at its subsequent assembly, after officers delivered a jumbo hike final week.

“Immediately’s shock on inflation considerably will increase the percentages that we do see one other 50-basis-point hike in June,” Josh Nye, an economist at Royal Financial institution of Canada, mentioned in an interview on BNN Bloomberg Tv. “The market was beginning to lean in that course and I believe that is solely going so as to add to that.”

Bonds had been hit arduous. The benchmark Canadian authorities two-year yield shot as much as almost 2.56% — the best since October 2008 — from about 2.52% earlier than the discharge. The ten-year yield moved above 2.8%.

Costs rose by 1.4% in March alone, the largest one-month enhance because the nation launched a federal gross sales tax in 1991.

The studying might signify the height of the run-up in annual worth beneficial properties, capturing the affect of hovering meals and power prices after Russia’s invasion of Ukraine. Nonetheless, the return to something resembling regular is predicted to be extended and that’s a fear for policymakers making an attempt to stop inflation expectations from hardening at present ranges.

And whereas gasoline costs had been the largest contributor to the month-to-month and annual achieve in costs, inflation has turn into broad-based with sharp will increase in prices for housing, meals and vehicles. The typical of the central financial institution’s core measures — usually seen as a greater indicator of underlying worth pressures — rose to three.77%, additionally the best since 1991.

Items inflation hit 9.2% in March, the best since 1982. Companies inflation rose to 4.3%, the best since 2003.

Macklem and his officers forecast inflation would gradual to a median 4.5% by the fourth quarter of this 12 months. Inflation averaged 5.8% within the first quarter, versus Financial institution of Canada estimates of 5.6%.

On a seasonally adjusted foundation, costs jumped 0.9% in March, matching a file excessive. Gasoline costs had been up 12% on the month, and 40% from a 12 months earlier. Meals costs had been up 7.7% from a 12 months earlier, after a 0.9% achieve in March. Grocery costs had been up 8.7% on an annual foundation.

(Updates with market and economist response)

–With help from Erik Hertzberg.

Post a Comment