The central financial institution’s survey of executives paints an image of an economic system nonetheless pressed to its limits.

Canadian companies are dealing with unprecedented challenges assembly demand, together with elevated expectations for wages and inflation that can bolster bets for aggressive charge hikes from the Financial institution of Canada.

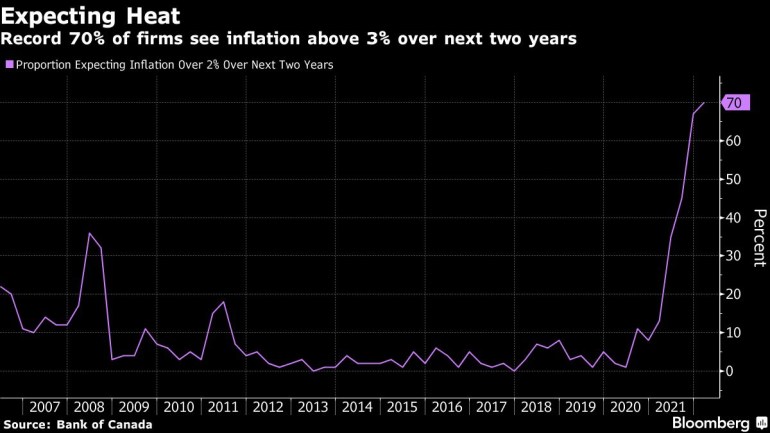

The central financial institution’s quarterly survey of executives paints an image of an economic system nonetheless pressed up towards its limits. 4-fifths of firms stated they'd have not less than some problem assembly surprising demand, a report. About 70% of respondents anticipate annual shopper worth good points to surpass 3% over the subsequent two years, additionally a report, with experiences of upper anticipated wage progress pervasive.

The rising price and inflation outlook will solely cement bets that the Financial institution of Canada is poised to drive up borrowing prices sharply in coming months. Markets are pricing in a virtually 80% likelihood the central financial institution will hike its coverage charge — presently at 0.5% — by half a share level at its April 13 choice, and lift it to as a lot as 3% by this time subsequent yr.

That may characterize one of many quickest tightening cycles prior to now three a long time.

“The variety of corporations reporting capability pressures associated to labor or provide chain challenges is at a report excessive,” the Financial institution of Canada stated within the launch. “Due to persistent capability pressures and robust demand, corporations anticipate important progress in wages, enter costs and output costs.”

The Canadian greenback prolonged good points on the report, and was up 0.4% to C$1.2473 per U.S. greenback.

“If we nonetheless wanted to cement the case for a half level charge hike in April, the Financial institution of Canada’s Enterprise Outlook survey supplied it,” Avery Shenfeld, chief economist at Canadian Imperial Financial institution of Commerce, stated in a report back to buyers. “The close to time period inflation pressures highlighted within the survey are what make a 50 foundation level transfer in April appear to be an affordable step at this level.”

A broad gauge of enterprise sentiment fell barely from report ranges, partly as a result of gross sales progress is predicted to sluggish. The central financial institution’s composite indicator of enterprise situations fell to 4.98, from a report excessive 5.90 within the fourth quarter.

About half of firms surveyed stated they anticipate gross sales progress to say no over the subsequent 12 months, and indicators of future gross sales are easing. However gross sales stay robust, the Financial institution of Canada stated. Expectations for funding in equipment and gear and hiring additionally stay elevated, although down from the top of final yr.

The survey did present, nevertheless, elevated expectations for enter prices, pricing and wages. About 46% of corporations see an acceleration in enter inflation, whereas 51% anticipate output worth will increase to speed up. Common anticipated wage will increase are seen at 5.2%, a report.

This survey was performed from Feb. 7 to Feb. 25, although the Financial institution of Canada did follow-up interviews final month to ask about Ukraine.

Nonetheless, the survey discovered that almost all companies anticipated inflation to finally return to focus on.

A separate survey of shopper expectations confirmed Canadian households additionally anticipate inflation to remain above 3% over the subsequent couple of years. Requested what they anticipate the speed of inflation to be sooner or later, Canadians noticed it at 5.07% within the subsequent yr and 4.62% in two years. That’s increased than three months in the past. Inside 5 years, inflation is seen at 3.23%, which is down from the earlier survey.

(Updates with chart, analyst remark.)

–With help from Randy Thanthong-Knight and Erik Hertzberg.

Post a Comment