Because the RBI focuses on managing India’s debt, propping up development, inflation soars.

New Delhi, India–The Reserve Financial institution of India (RBI) stands aside as a uncommon instance of a central financial institution right now that has shunned rate of interest hikes within the post-pandemic period and remained open to fee cuts, regardless of rising inflation.

Because the RBI’s financial coverage committee (MPC) meets from April 6-8 to determine its newest rate of interest coverage, official paperwork reviewed by The Reporters’ Collective (TRC) and Al Jazeera present the RBI has thus far saved rates of interest low by exploiting what the Ministry of Finance treats as a built-in “escape clause” within the financial coverage, which allows inflation to rise above the mandated goal of 4 %.

Within the course of, the federal authorities has been in a position to borrow much-needed funds from the markets at decrease prices for the reason that RBI can also be tasked with managing the sovereign debt.

TRC obtained the paperwork, a part of a trove that varieties the idea of a three-part investigative collection into the Modi authorities’s affect over the central financial institution, beneath the Proper to Data Act. (See Half 1 & Half 2.)

At its December 2021 assembly, the RBI’s MPC saved rates of interest unchanged, saying the financial restoration wanted “sustained coverage assist” and that it could “anticipate development alerts to turn out to be solidly entrenched whereas remaining watchful on inflation dynamics”. In February 2022, the RBI shocked observers by once more declining to alter its financial coverage stance, citing “uncertainties associated to Omicron and international spillovers” and a manageable inflation outlook.

The selections have triggered debate amongst coverage analysts, a few of whom took it as proof of the RBI giving larger precedence to its different aims of development and public debt administration. Because the RBI borrows for the federal government, decrease rates of interest assist the federal government elevate cash at decrease charges from the market.

Das, in his public statements, has justified the MPC’s selections by sustaining that the central financial institution is prioritising financial development.

“Whereas on the face of it the RBI says that development is a precedence, we really feel it’s primarily their debt administration accountability that has prevented them from rising the rates of interest,” says Radhika Pandey, a fellow on the Nationwide Institute of Public Finance and Coverage (NIPFP).

“The RBI ought to have at the least acknowledged that inflation is getting entrenched,” she provides. Pandey is amongst those that labored intently with the finance ministry to assist draft India’s inflation-targeting financial coverage framework.

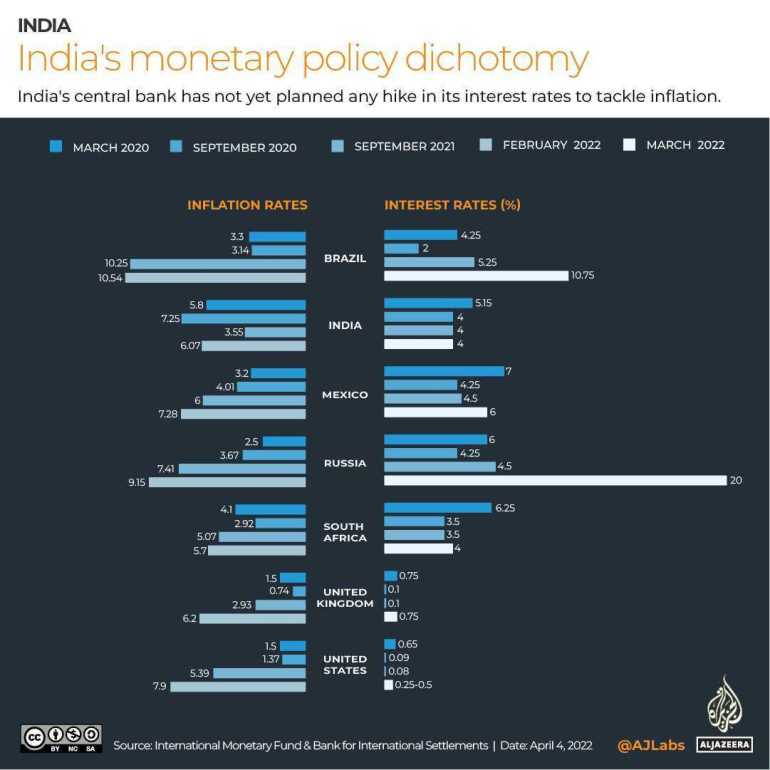

Amid spiking inflation worldwide, central banks are winding down straightforward cash insurance policies. The Financial institution of England just lately raised rates of interest for the third time in a row, whereas the US Federal Reserve in March carried out the primary of six deliberate fee hikes for this 12 months. Even the rising market central banks in Brazil, Mexico, South Africa, Chile, Russia, to call a couple of, have began rising charges, protecting value stability as their precedence.

However not India, the place the inflation fee has been on the rise for 5 consecutive months, even earlier than the Russia-Ukraine struggle. The inflation fee reached 6.1 % in January 2022 and 6.07 % the next month. And costs are anticipated to proceed to rise. Japanese brokerage agency Nomura Holdings Inc initiatives that inflation will attain 6.2 % within the monetary 12 months that began this April, nicely above the RBI’s projections of 4.5 %, as a result of increased gasoline costs, rising farm enter prices and commodity costs. Analysts anticipate the RBI to alter its inflation forecast within the upcoming financial coverage assembly.

Hovering sovereign debt

By not mountain climbing rates of interest, the central financial institution helps the federal authorities maintain its borrowing value low.

The Indian authorities plans to borrow 15 trillion rupees ($200bn) in 2022-23, up from 10.5 trillion rupees ($140bn) in 2021-22 and 12.6 trillion rupees ($165bn) in 2020-21.

Whereas embarking on a brand new financial coverage regime to focus on inflation in 2015, policymakers had steered debt administration be hived off to a separate entity to keep away from a battle of curiosity within the RBI’s coverage aims.

“In gentle of worldwide expertise and suggestions of professional committees, it's evident that there's an inherent battle between financial coverage and debt administration features,” then-Principal Financial Adviser Ila Patnaik stated in an inner observe dated February 11, 2015, which was seen by TRC and Al Jazeera. “Subsequently, financial coverage aims shouldn't be included within the RBI Act till the general public debt administration perform is carved out from the RBI Act.”

The Indian authorities tried to handle this anomaly by proposing modifications to the regulation to ascertain a debt administration company and switch oversight of the federal government bond market from the RBI to the capital market regulator, the Securities & Alternate Board of India (SEBI). However it withdrew the proposal after the RBI objected to giving up its debt administration position.

The NIPFP’s Pandey stated the a number of aims that the RBI is saddled with, particularly managing sovereign debt, don't bode nicely for the financial system and “if inflation shouldn't be anchored at this level of time, inflationary expectations will get entrenched and it is going to be tough to manage costs”.

Nonetheless, Jayanth R Varma, an exterior member of the MPC, stated debt administration shouldn't be a consider deciding rates of interest and there's no battle of curiosity as half of the committee members are exterior consultants.

“I want to assume that senior functionaries of the RBI who sit on the MPC have the mental integrity and epistemological dexterity to maintain their MPC position separate from their RBI roles, and that they might vote within the MPC solely on the idea of the statutory mandate entrusted to the MPC,” Varma stated. “Furthermore, half of the MPC consists of impartial exterior members who should not conflicted on this method.” (His full response is right here.)

The Ministry of Finance and the RBI didn't reply to an inventory of questions from Al Jazeera.

Completely different priorities

At a customary assembly with reporters following the financial coverage announcement on December 8, 2021, a journalist requested Governor Das an easy, but essential, query: “What must be the precedence for India’s central financial institution, development or inflation?”

“As I've clearly talked about in my assertion, the overarching precedence of RBI at this stage is revival of development,” Das stated. “And in parallel, I've stated that value stability can also be our concern. So, subsequently, at this second, with out shedding sight of value stability, we might make development because the overarching precedence.”

Das is well-versed in arguments towards uncontrolled inflation. Again in 2016, Das, because the financial affairs secretary, was concerned in drafting the cupboard observe laying down the financial coverage targets. The cupboard observe reads: “The foremost and the dominant goal of financial coverage should be to anchor inflation expectations and to handle deviations from fascinating ranges of inflation.”

Indian regulation states that “the first goal of the financial coverage is to take care of value stability whereas protecting in thoughts the target of development”. Nonetheless, since taking up in 2018, Das has pressured repeatedly that supporting financial development is equally or extra necessary than value stability for the central financial institution, even when the financial system is again on the restoration path, like it's now, however inflation charges proceed to rise.

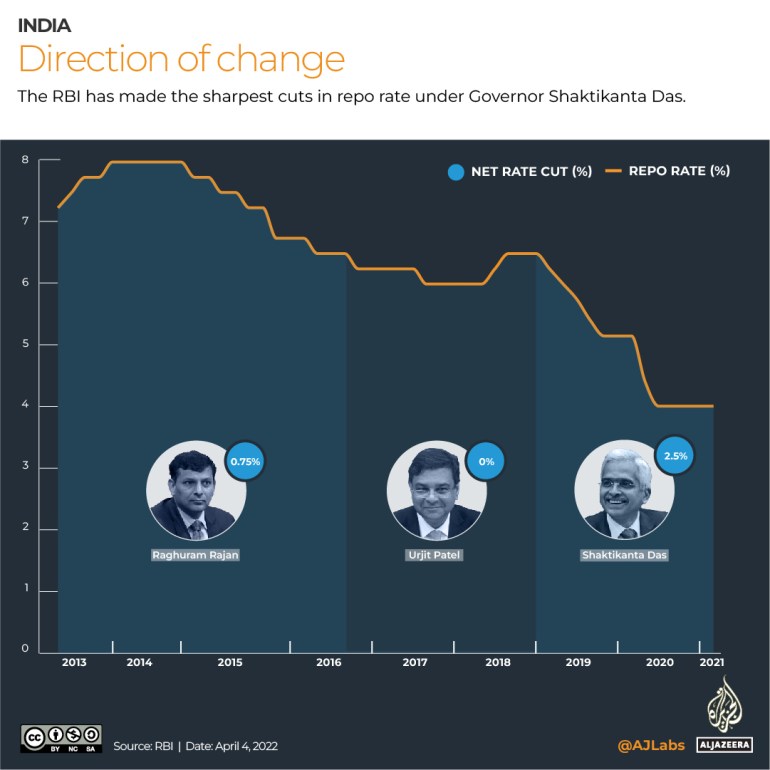

Below Das, the MPC started pumping cash into the financial system with 5 successive sharp rate of interest cuts in 2019. In complete, the RBI lowered the repo fee – the speed at which banks borrow from the RBI – by a file 135 foundation factors (100 foundation factors equals 1 proportion level) between February 2019 and February 2020. With the onset of the pandemic, Das signalled a continuation of free coverage by asserting the central financial institution would do “no matter is important” to assist development. The RBI minimize rates of interest by 115 foundation factors in 2020 to an all-time low of 4 %, regardless of excessive ranges of inflation.

One of many key causes for the completely different strategy that Das has adopted is the distinction in decoding the aims of the financial coverage enshrined within the regulation, consultants say.

Willem H Buiter, adjunct professor of worldwide and public affairs at Columbia College, stated the RBI beneath Das has both “de facto modified its goal perform to at least one that provides larger weight to actual financial exercise than to cost stability, or it's underestimating the severity and persistence of the inflation problem it faces”.

The pandemic

Regardless of inflation dropping in most elements of the world when the pandemic hit, India’s value development remained excessive – averaging 6.2 % for the monetary 12 months April 2020 to March 2021 – fuelled by supply-side bottlenecks and the federal government’s transfer to tax gasoline.

In all of the MPC conferences held for the reason that pandemic, the central financial institution has stated it would “proceed with the accommodative stance so long as it's essential to revive and maintain development on a sturdy foundation” and mitigate the impact of COVID-19 on the financial system “whereas guaranteeing that inflation stays inside the goal”. An accommodative stance signifies that the central financial institution will stay open to rate of interest cuts.

That is regardless of the inflation fee being on the rise since October because the financial system continues to rebound from the pandemic.

Not all members of the MPC are snug with this stance.

Varma, who joined the MPC in August 2020, has objected to the RBI making financial development the paramount concern.

“By creating the faulty notion that the MPC is not involved about inflation and is focussed solely on development, the MPC could also be inadvertently aggravating the danger that inflationary expectations shall be disanchored,” Varma stated in the course of the committee’s August 2021 assembly, in keeping with minutes of the gathering.

Varma has dissented from the RBI’s accommodative stance since then, making the case that the MPC should exhibit its dedication to the inflation goal with “tangible motion”, which can assist in sustaining decrease rates of interest for longer, “thereby aiding the financial restoration”.

Authorities’s coverage sign

Again in 2016, when it was setting the inflation goal the federal government, after consulting with the RBI, its former governors and a number of other professional committees, determined that if costs rose at 4 %, it could truly let the financial system develop at its most effective tempo. Something increased than that might instantly hit the wallets of frequent Indians.

“A goal of 4 % +/(-) 2 % would give ample flexibility to RBI. In any case, a CPI inflation of greater than 6 % (4 % + 2 %) can be unacceptable,” Das wrote in a finance ministry file in July 2016.

Whereas discussing the inflation targets in March 2021 for the subsequent 5 years, the finance ministry delved into whether or not there must be an escape clause in particular circumstances, paperwork reviewed by TRC and Al Jazeera present. The Czech Republic and Romania have official escape clauses to permit their central banks to shelve their inflation goal within the case of an financial shock.

The finance ministry got here to the conclusion that, although not written within the regulation, India’s inflation goal already operated equally to these of central banks with such a clause because it allowed for a spread of figures, “operationally similar to level goal with escape clauses”. Most international locations have a spread however normally set it nearer to their inflation goal. India and Turkey are the one two international locations the place the vary is as excessive as 2 % in both route.

Furthermore, not like most international locations the place if the inflation goal is missed even for a month it's thought of a technical failure of the central financial institution, India permits the goal to be missed for 3 consecutive quarters earlier than qualifying it as a “failure”. These two financial coverage options “may very well be construed as equal to” having a versatile regime with an escape clause, in keeping with a finance ministry observe dated February 25, 2021.

Inflation has hovered simply over the central financial institution goal of 4 % in solely 5 out of twenty-two months from November 2019 to February 2022. It's anticipated to shoot up additional within the coming months as a result of rising commodity and oil costs due to the Russia-Ukraine battle.

In late March, Das stated the 6 percent-plus inflation of latest months was “non permanent” and defended the central financial institution’s transfer to not tighten its financial coverage stance by arguing that “a untimely demand compression” can be counterproductive.

Columbia’s Buiter, nonetheless, stated such an outlook was mistaken.

“It's time to recognise that this inflation shouldn't be transitory or non permanent, that it isn't pushed by short-live provide shocks and will increase in international fossil gasoline costs which can be unlikely to be repeated,” he stated. Furthermore, if the RBI is severe about its medium-term inflation goal of 4 %, “it must be elevating its coverage charges now”, he added.

Somesh Jha is a member of The Reporters’ Collective.

Post a Comment