The self-ruled island’s dominance in semiconductors is seen by some analysts as a deterrent in opposition to an invasion by Beijing.

Since Russia invaded Ukraine, Taiwan’s safety has been on the lips of policymakers and analysts the world over, amid predictions China may someday comply with Moscow’s lead and try to take over the island nation.

Each Taiwan and Ukraine are younger democracies, whose nationwide id and political independence face the specter of aggression from a neighbouring superpower.

Taiwan, nonetheless, has a little-discussed secret weapon that Ukraine didn't have – a dominance in manufacturing semiconductors that some analysts say may show essential in deterring an invasion by Beijing.

An invasion of Taiwan may set off unprecedented international financial fallout because of the island’s place as arguably probably the most susceptible single level of failure within the expertise worth chain.

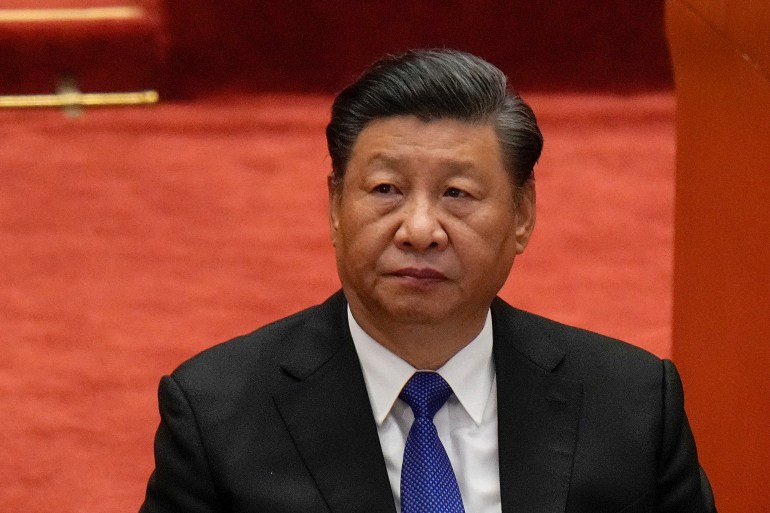

Taipei’s “silicon protect” makes the stakes particularly excessive for China. Whereas Chinese language President Xi Jinping has pledged to reclaim the self-ruled island by power if obligatory, Beijing depends closely on Taiwanese expertise to energy key industries that it's banking on to double its gross home product (GDP) by 2035.

“Taiwan’s built-in deterrence technique should maintain this stark alternative between nationwide goals for Beijing clear,” Jared McKinney, a scholar at Air College, informed Al Jazeera. “Both conquer Taiwan or keep financial prosperity.”

“A query delayed is an invasion denied,” McKinney stated.

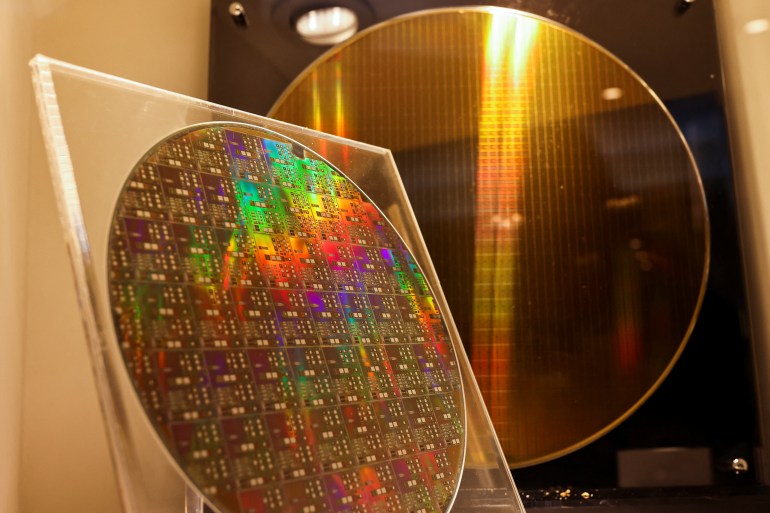

Taiwan accounts for 92 % of worldwide manufacturing for semiconductor course of nodes under 10 nanometres (1 nanometre is one-billionth of a metre), making it the principle provider of the overwhelming majority of chips that energy the world’s most superior machines, from Apple iPhones to F-35 fighter jets.

A one-year disruption to the Taiwanese chip provide alone would value international tech corporations roughly $600bn, in keeping with a research by the Boston Consulting Group. Within the occasion its manufacturing base was destroyed in a struggle, rebuilding manufacturing capability elsewhere would take at the least three years and $350bn, the research discovered.

“China is nice at algorithms, software program, and market options,” Ray Yang, a consulting director at Taiwan’s Industrial Know-how Analysis Institute, informed Al Jazeera. “However their business wants many high-performance laptop (HPC) chips that they don't have.”

“If a battle interrupted their provide, it will dramatically decelerate China’s AI and 6G ambitions,” Yang stated. “They must reorder their total industrial technique.”

That dependence could possibly be additional exploited by Taipei to buttress its nationwide safety, in keeping with some navy analysts.

‘Warning sign Chinese language policymakers can’t ignore’

McKinney, who burdened his views don't essentially signify these of Air College or the US Air Power, stated Taiwan’s “silicon protect” ought to be much less a “dedication system” for American defence than a deterrent in opposition to Chinese language aggression.

Final yr McKinney and Peter Harris, an affiliate professor of political science at Colorado State College, printed a paper on a “damaged nest technique” for deterring China. They proposed Taiwan may credibly threaten to destroy business chief TSMC’s infrastructure on the onset of an invasion, which might deny Beijing entry to its chips and inflict critical harm to its economic system.

McKinney stated deterrence could possibly be boosted additional by instituting a multilateral semiconductor sanctions regime whereby america, South Korea, and Japan joined with Taiwan to halt semiconductor exports to China if it began a struggle.

“If the ask is to sanction the entire Chinese language economic system, you won't get sufficient buy-in,” he stated, expressing doubt that conglomerates with deep publicity to China’s market would pull out.

“The comparatively modest scope of semiconductor sanctions makes them extra credible as a deterrent, making it a warning sign Chinese language policymakers can’t ignore.”

Although China stays depending on Taiwanese tech for now, it's working arduous to show the tables amid allegations of expertise poaching and mental property theft. Taiwan bans Chinese language-funded corporations from investing in high-end expertise and people who violate incoming “financial espionage” legal guidelines may spend as much as 12 years behind bars. Final month, Taiwan raided eight Chinese language tech corporations and interrogated 60 Chinese language scouts who had been allegedly attempting to poach Taiwan’s high engineers.

“The largest risk to Taiwan’s continued technological dominance is expertise poaching from mainland China,” James Lee, an knowledgeable on US-Taiwan relations who will take up an instructional publish with Taiwan’s Academia Sinica later this yr, informed Al Jazeera.

“To date, it [China] hasn’t succeeded for high-end chips … however it's believable that they might succeed in some unspecified time in the future, and given the sheer quantity of sources that Beijing has at its disposal, Taiwan’s going to be beneath fixed strain.”

Ross Feingold, a Taipei-based lawyer, informed Al Jazeera IP theft is a specific concern.

“Because of drawn-out court docket proceedings and slight penalties, the regulation doesn't encourage sufficient worry to discourage people from routinely stealing commerce secrets and techniques or insider data from companies,” Feingold stated.

Nevertheless, Yang doesn't see this as a giant fear for main companies like TSMC.

“They're very sensible and have a really refined system to guard their most delicate data,” he stated.

Taiwan’s tech dominance impacts Washington’s danger calculus, too. The US has no defence treaty with Taiwan, whereas the controversy is heating up in Washington over whether or not it ought to keep its long-held coverage of “strategic ambiguity” or change to “strategic readability”.

“I see US technological dependency on Taiwan as an efficient – and even preferable – substitute to a coverage of strategic readability,” Lee stated.

“It locks america into defending Taiwan to guard the island’s semiconductor business, however it doesn’t imply that america is treating Taiwan as an ally or supporting Taiwan’s independence.”

But, with Washington investing $52bn into reshoring chip manufacturing and homegrown hero Intel edging to change into the world’s most superior chipmaker once more, the US is probably not technologically depending on Taiwan for lengthy.

“If america began manufacturing the world’s most superior chips, that will make Taiwan much less essential to america and would consequently make the US much less prone to defend Taiwan, however that's nonetheless very a lot a theoretical situation,” Lee stated.

“Intel may be capable of attain this tier of elite producers if there may be substantial private and non-private funding in america over the course of the subsequent 10-20 years, however even when that occurs, it’s not prone to displace TSMC altogether.”

‘De-globalisation’

Even when Intel catches up technologically, there isn't any assure business gamers is not going to nonetheless favor TSMC.

“That is what Intel must cope with,” Yang stated. “TSMC is totally trusted by its worldwide companions since [unlike Intel] it doesn't have its personal product and doesn't compete with them.”

“International semiconductor making targeting the island thanks to a few many years of globalisation that prioritised low prices and economies of scale. However now de-globalisation could be very a lot beneath means as industrial and nationwide leaders worldwide get up to the fact of black swan occasions.”

Adjusting to the brand new actuality of provide chain vulnerability, main companies are transferring course of capability exterior of Taiwan. TSMC will kick-start the development of semiconductor fabrication vegetation in Arizona and Japan’s Kumamoto in 2024. Taiwan’s UMC, the world’s third-largest chipmaker, is because of open a plant in Singapore the identical yr.

Yang believes worldwide companies that beforehand saved by offshoring manufacturing will search to offset the prices of reshoring via technical breakthroughs that shall be achieved with the help of Taiwan.

“An increasing number of gamers from up and down the provision chain are coming and organising right here to get nearer to Taiwan’s ecosystem, be it Dutch lithographic gear makers, Japanese chemical suppliers, and others,” he stated.

“Taiwan will nonetheless lead the entire ecosystem as a result of worldwide gamers want to affix with us to innovate the subsequent technology of chips.”

Post a Comment