The choice additional complicates Russia’s makes an attempt to maintain assembly debt obligations amid the sanctions imposed after it invaded Ukraine.

Russia’s efforts to keep away from a sovereign default took one other blow after the U.S. Treasury halted greenback debt funds from the nation’s accounts at U.S. banks.

The choice additional complicates Russia’s makes an attempt to maintain assembly debt obligations amid the sanctions imposed after it invaded Ukraine. As the federal government tries to sidestep its first exterior default in a couple of century, these restrictions have hampered and delayed the method of transferring cash to bond holders.

Different governments are additionally planning harder sanctions after allegations that Russian troops massacred civilians in Bucha and different Ukrainian cities. The European Union is proposing to ban coal imports from Russia, which might be a serious step-up for a area that’s thus far shied away from focusing on vitality flows essential to the bloc’s financial system.

The U.S. announcement is meant to pressure Russia into both draining its home greenback reserves or spending new income to make bond funds, or else go into default, in response to a spokesperson for the Treasury’s Workplace of International Property Management, who mentioned particulars on situation of anonymity.

“Clearly this newest announcement by the U.S. Treasury is designed to place further stress on the Russians,” stated Gary Kirk, a portfolio supervisor at TwentyFour Asset Administration. “The choice fee strategies are considerably extra punitive and more difficult for Russia and therefore it does enhance the probabilities of a technical default.”

Regardless of warnings from credit-rating corporations and others, Putin’s authorities has thus far stayed present on its international debt obligations.

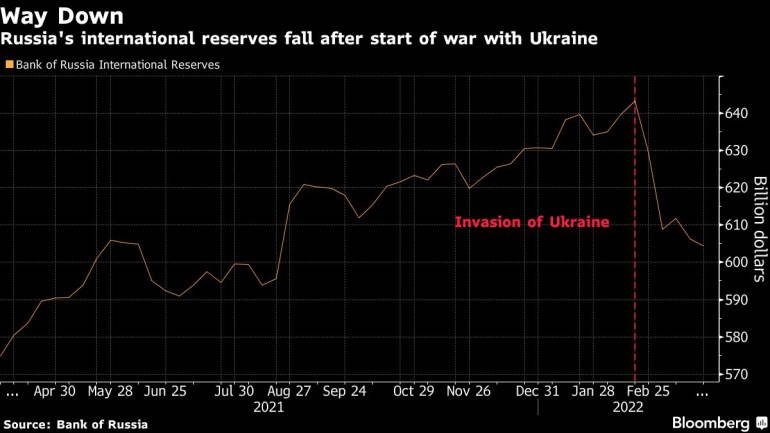

However the sweeping sanctions have already led to the seizure of an estimated two-thirds of Russia’s reserves. The central financial institution says it’s additionally offered a few of its foreign currency echange to assist the ruble, leaving questions on how lengthy it may possibly pull from its native coffers to pay its money owed.

Russia’s foreign-currency and gold reserves have been about $604 billion as of March 25, down $38.8 billion from a February peak. Nonetheless, it’s reaping in large sums from exports of vitality. Bloomberg Economics expects it'll earn almost $321 billion this 12 months if the commodities proceed flowing.

However even with the funds, funds haven’t been easy, with many delayed by banks doing prolonged checks to make sure they aren’t breaching sanctions.

A once-$2 billion greenback bond that matured Monday served as the latest stress check, although Russia was in a position to purchase again about three-quarters of the excellent quantity in rubles earlier than the notice got here due. The most recent U.S. transfer will intensify scrutiny on its means to pay again the rest of that debt.

Moreover, coupon funds due Monday on a 2042 bond had but to achieve some investor accounts as of Tuesday morning in London, in response to bondholders who declined to be named as a result of they aren't approved to talk publicly.

Russia’s greenback bonds, which have been already buying and selling nicely into distressed territory, fell on Tuesday. The 2042 declined 7 factors to about 28 cents on the greenback, in response to CBBT pricing.

The U.S. announcement “will increase the chance of default, not due to lack of cash,” stated Lutz Roehmeyer, chief funding officer at Berlin-based Capitulum Asset Administration. “The brand new sanction will trigger technical points with regard to the settlement methods, so it's now an open query how Russia will assemble the fee routes.”

(Updates with EU, remark from analyst, beginning in third paragraph)

–With help from Giulia Morpurgo, Lilian Karunungan, Netty Ismail, Colleen Goko, Libby Cherry, Irene García Pérez and Carolina Wilson.

Post a Comment