Liberal-Nationwide Coalition and centre-left Labor Get together operating neck and neck in election centered on rising costs.

Hobart, Australia – Penny-pinching is a lifestyle for Australian David Jobling. The Adelaide man lives in public housing, suffers from power ache and survives on a incapacity pension of 450 Australian dollars ($316) per week.

However with the price of dwelling rising, he's beginning to really feel the panic set in.

Although he's accustomed to dwelling on a tiny revenue, the 60-year-old actor and author by coaching will not be positive his funds can stretch any additional.

“I’ve carried out my analysis when it comes to what I can do inside my limits,” Jobling informed Al Jazeera, including there may be “not a number of incentive” to do the occasional informal work he picks up as a result of it reduces the worth of his pension funds. “However costs are rising, and it’s scary.”

He’s not alone.

Forward of Australia’s federal election on Saturday, the price of dwelling has turn out to be a pivotal problem for voters. Almost half of Australians are extra anxious about their potential to make ends meet than they have been a 12 months in the past, with younger folks, ladies and low-income earners essentially the most involved, in keeping with an opinion ballot launched final month.

Even rich Australians seem anxious, as rising costs and sinking inventory markets gnaw away at funding portfolios and newspapers geared toward well-to-do professionals run articles with tips about stopping inflation and “getting away together with your wealth”.

Australia’s inflation charge hit 5.1 p.c in the course of the first quarter, pushed by hovering prices of meals, housing, training and transport. Though not as extreme as in the USA or the UK – the place inflation is operating at 8.3 p.c and 9 p.c, respectively – the determine marked the steepest rise in costs in additional than twenty years.

Home costs rose particularly sharply, surging a document 18.1 p.c in 2021/22 – though there are some indicators the market may very well be close to the height.

With the typical home in Sydney and Melbourne promoting for greater than 1 million Australian dollars ($700,000), many younger adults are pressured to maintain dwelling at house with their dad and mom nicely into their 20s and 30s. Petrol costs in March hit new data, going as excessive as 2.40 Australian dollars ($1.70) per litre in some elements of the nation.

In the meantime, wage progress has stagnated over the previous decade, which means Australians are paying extra with much less cash within the family funds. In January-March, wages grew by 2.4 p.c – lower than half the speed of inflation.

The rising price of dwelling within the “Fortunate Nation” has hit exhausting in a nation accustomed to repeatedly rising dwelling requirements after 31 years of financial progress that was solely interrupted when the pandemic hit.

Regardless of the price of dwelling dominating the election marketing campaign, each the incumbent Liberal-Nationwide Coalition and centre-left Labor Get together have confronted criticism for not providing sufficient to alleviate the ache.

Whereas Prime Minister Scott Morrison has campaigned for weeks on price of dwelling points, rolling out excise tax cuts and a scheme to permit first house consumers to faucet into their retirement financial savings, he has largely blamed abroad occasions such because the battle in Ukraine for the monetary squeeze.

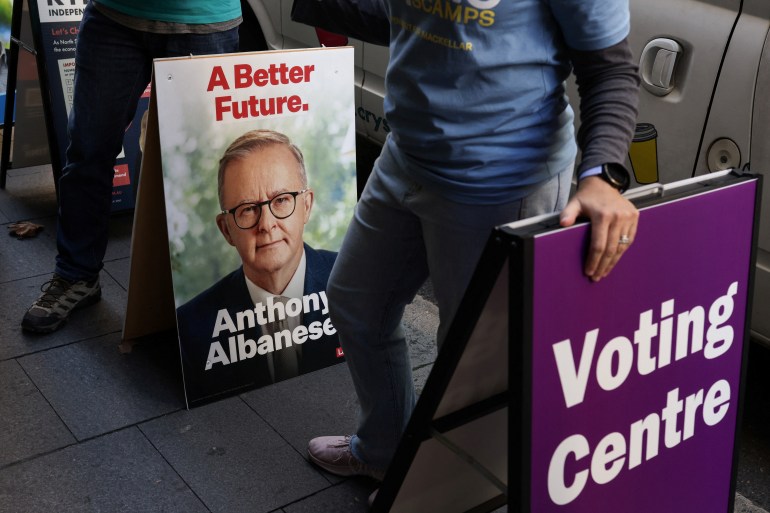

Opposition Chief Anthony Albanese has been criticised for providing little element about how households can be higher off total underneath Labor’s plans to handle the rising price of dwelling.

The centrepiece of Labor’s manifesto is a scheme underneath which the federal government would pay as much as 40 p.c of the price of a brand new house. The ‘Assist to Purchase’ scheme can be accessible for as much as 10,000 properties a 12 months.

The 2 events are operating neck and neck, after Labor’s substantial lead narrowed in current days.

Rising rates of interest to tame inflation are additionally including to the squeeze, spurring greater mortgage repayments for tens of millions of Australians.

Claire Victory, nationwide president of the St Vincent de Paul Society, mentioned politicians ought to take “pressing motion” to help Australians dwelling in or susceptible to falling into poverty.

“Rate of interest hikes will add to those pressures and disproportionately affect essentially the most susceptible folks in the neighborhood, who're already struggling to get by, typically with restricted household or social help networks,” Victory informed Al Jazeera.

The worst is probably going but to come back, with Australians warned that inflation will proceed to rise this 12 months and presumably the subsequent.

Michael Kodari, the CEO of Kodari Securities, mentioned Australians may take consolation in realizing the hovering costs are unlikely to be a long run drawback.

“Because it was born from the aftershock of the pandemic, this era of inflation will not be an indication of a power state of affairs and can seemingly resolve itself in time,” Kodari informed Al Jazeera.

Within the meantime, Australians like Jobling, who will not be a fan of both main social gathering and is contemplating voting for the minor Australian Greens, are hunkering down.

“I do know what I’ve received accessible to spend proper right down to the cent each single day and I simply can't go over that,” he mentioned.

Post a Comment