The conflict in Ukraine and the following sanctions in opposition to Russia are pushing oil volatility to historic ranges.

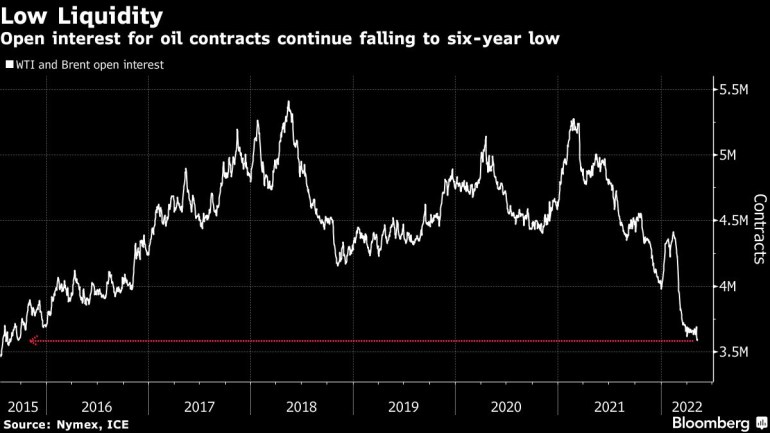

Oil jumped to close $105 after slumping for 2 days as liquidity and volumes stay low, exacerbating market strikes.

West Texas Intermediate futures rebounded greater than $5 after falling under $100 a barrel on Tuesday. Oil is experiencing one in every of its most tumultuous buying and selling intervals ever because the conflict in Ukraine and the following sanctions in opposition to Russia push volatility to historic ranges. Covid infections in Shanghai and Beijing dropped on Tuesday, offering some cautious optimism of enchancment after lockdowns led to surging inflation in April.

The oil market hasn’t been “constant in any respect as of late, which has turned many away from buying and selling the commodity,” mentioned Rebecca Babin, senior vitality dealer at CIBC Personal Wealth Administration. “Buying and selling crude proper now's like attempting to determine the temper swings of a teen. It could possibly really feel like a futile endeavor.”

The oil market has been whipsawed during the last couple of months by Covid-19 restrictions throughout China and Russia’s invasion of Ukraine. The conflict has fanned inflation, driving up the price of every thing from meals to fuels, with retail gasoline within the US hitting a recent document forward of the summer season driving season. Within the US, client costs rose greater than anticipated, indicating inflation will persist at elevated ranges for longer.

“Oil costs are bouncing again strongly from two days of hefty losses amid a tightening provide outlook,” brokerage PVM Oil Associates wrote in a observe.

Costs

- WTI for June supply rose $5.17 to $104.95 a barrel at 10:03 in New York.

- Brent for July settlement gained $4.49 to $106.87.

The American Petroleum Institute reported US crude stockpiles rose by 1.62 million barrels final week, in response to folks conversant in the figures. Gasoline inventories additionally expanded. Authorities knowledge is due later Wednesday.

Merchants proceed to observe the EU’s efforts to agree sanctions on Russian oil imports. On Wednesday, Hungary mentioned it can solely agree if shipments by way of pipelines are excluded.

Shanghai reported a 51% drop in new coronavirus infections on Tuesday, with zero instances discovered in the neighborhood — a key metric for town to finish a punishing lockdown that’s snarled world provide chains and left tens of thousands and thousands of individuals caught inside their houses for about six weeks.

Associated protection:

- Libya’s Closed Oil Fields to Restart, Parliament-Backed PM Says

- IAEA Sounds Alarm on Iran Atomic Work as EU Tries to Save Deal

- US Crude Output Progress Anticipated to Gradual Amid Hovering Prices

- California Seeks 91% Minimize to Oil Use in Revamped Local weather Plan

Post a Comment