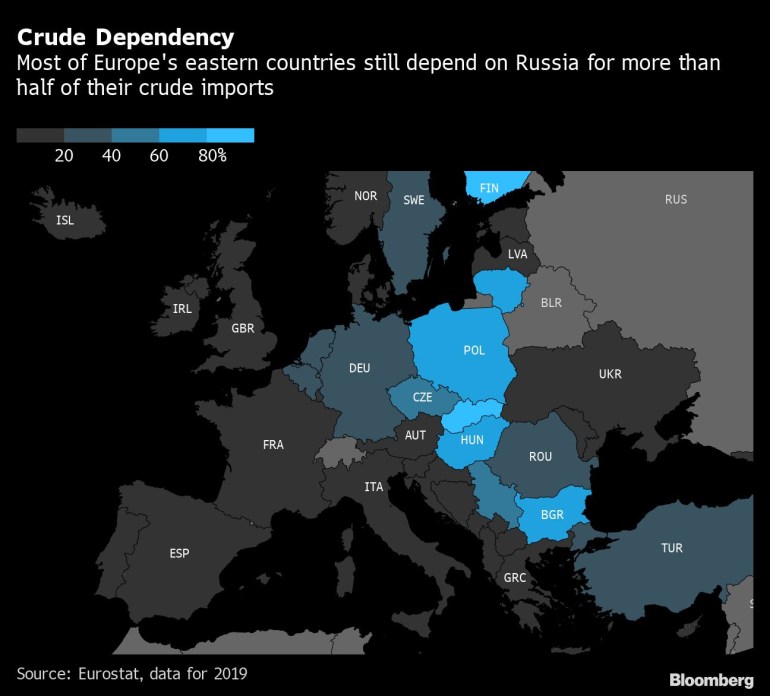

Most Jap European nations nonetheless rely on Russia for greater than half of their crude imports.

European nations already reeling from file inflation danger aggravating their plight with the choice to close themselves off from Russian oil imports.

Whereas European Fee President Ursula von der Leyen guarantees the deliberate embargo might be carried out “in a manner that enables us and our companions to safe various provide routes,” German Economic system Minister Robert Habeck has warned the area’s prime economic system will endure, citing potential shortages and additional upward strain on costs.

The step is seen as extra manageable than disrupting flows of Russian pure gasoline. However an oil ban leaves the world with much less provide because the U.S. and Europe face the quickest inflation in many years alongside wilting confidence due to the struggle in Ukraine.

“Russian oil might be changed on the world market within the quick time period, however with further prices and logistical challenges,” German business commerce group BDI stated Wednesday. “Given the oil embargo, vitality costs will in all probability to proceed to rise.”

The EU has lengthy agonized over whether or not it could possibly face up to being reduce off from a prime vitality provider, having acquired greater than 1 / 4 of its oil imports from Russia final 12 months.

The short-term impression of the EU’s proposal needs to be restricted as a result of the timetable is in keeping with present plans by governments to wean themselves off Russian oil, in keeping with Klaus-Juergen Gern, an economist on the Kiel Institute for the World Economic system.

Even so, markets for refined merchandise like diesel, the place Russia is a vital provider, could “grow to be tight, and costs may improve additional,” Gern stated by cellphone. And whereas lockdowns in China may make it simpler to seek out alternate options to Russia for oil — that might change if the Asian nation’s economic system picks up once more.

JPMorgan economists Malcolm Barr and Greg Fuzesi stated in a report back to purchasers that the EU’s plans don’t change the financial outlook, cautioning that uncertainties over vitality provides stay.

Essentially the most excessive step can be a ban on Russian pure gasoline, which principally flows by means of pipelines and is more durable to interchange than oil as a result of sea deliveries from different suppliers couldn’t cowl the shortfall.

Fuel Risk

The IMF reckons EU output in 2023 can be about 3% decrease with out Russian oil and gasoline imports.

For Germany, the Bundesbank says exercise is prone to shrinking practically 2% in 2022 if an vitality embargo results in restrictions on energy suppliers and business. Some analysts have argued that the impression can be much less extreme, and that the economic system would be capable of deal with the shock.

Berenberg economist Holger Schmieding says Europe may section out Russian oil by year-end with out inflicting shortages and dramatic value will increase.

UBS World Wealth Administration stated that whereas the impression of the embargo on Europe’s financial development is prone to be “manageable,” uncertainty over provides will in all probability “hold vitality costs supported.”

(Updates with economist feedback beginning in sixth paragraph.)

Post a Comment