US central bankers are attempting to chill the most popular inflation in 40 years with out tilting the financial system right into a recession.

Most Federal Reserve officers agreed at their gathering this month that the central financial institution wanted to tighten in half-point steps over the following couple of conferences, persevering with an aggressive set of strikes that would depart coverage makers with flexibility to shift gears later if wanted.

“Most members judged that fifty basis-point will increase within the goal vary would doubtless be applicable on the subsequent couple of conferences,” minutes of the Fed’s Could 3-4 assembly launched Wednesday in Washington confirmed. “Many members judged that expediting the elimination of coverage lodging would depart the committee nicely positioned later this 12 months to evaluate the consequences of coverage firming and the extent to which financial developments warranted coverage changes.”

Treasury yields fluctuated, shares rose and the greenback pared its acquire following the report. Markets continued to point out merchants pricing in 100 foundation factors of price hikes over the following two conferences.

“There’s no disagreement within the committee — they’ve obtained to get transferring right here, so it’s not a giant shock. The true query goes to come back later, after we get into the autumn and after they resolve whether or not to decelerate or pause,” Ethan Harris, head of world economics analysis at Financial institution of America Corp, stated throughout an interview on Bloomberg Tv. “I feel the Fed has to danger a downturn,” he stated. “They’ve let issues run uncontrolled.”

After elevating rates of interest by a half-percentage level on the Could assembly, the minutes confirmed help by most officers to proceed such will increase over no less than their subsequent two gatherings with their inflation battle removed from gained.

Fed officers “famous that a restrictive stance of coverage could nicely change into applicable relying on the evolving financial outlook and the dangers to the outlook,” the minutes stated. They stated that labor demand continued to outstrip obtainable provide.

Within the weeks for the reason that assembly, financial-market volatility has spiked as buyers fret over the danger of a downturn. Shares have plummeted, Treasuries have rallied and buyers have pared again bets on how rapidly coverage charges will rise. Atlanta Fed President Raphael Bostic urged on Monday that a September pause “may make sense” if value pressures cooled. The minutes confirmed officers attentive to monetary circumstances as they put together to lift charges additional.

“A number of members who commented on points associated to monetary stability famous that the tightening of financial coverage may work together with vulnerabilities associated to the liquidity of markets for Treasury securities and to the non-public sector’s intermediation capability,” the minutes stated.

Fear concerning the outlook for company earnings and rising rates of interest has additionally roiled monetary markets. The Customary and Poor’s 500 inventory index was down 17% year-to-date by means of Tuesday, whereas U.S. Treasury two-year notes yielded 2.48% versus about 0.8% in early January.

On the assembly, officers additionally finalized plans to permit their $8.9 trillion steadiness sheet to start shrinking, placing extra upward stress on borrowing prices. Beginning June 1, holdings of Treasuries shall be allowed to say no by $30 billion a month, rising in increments to $60 billion a month in September, whereas mortgage-backed securities holdings will shrink by $17.5 billion a month, growing to $35 billion.

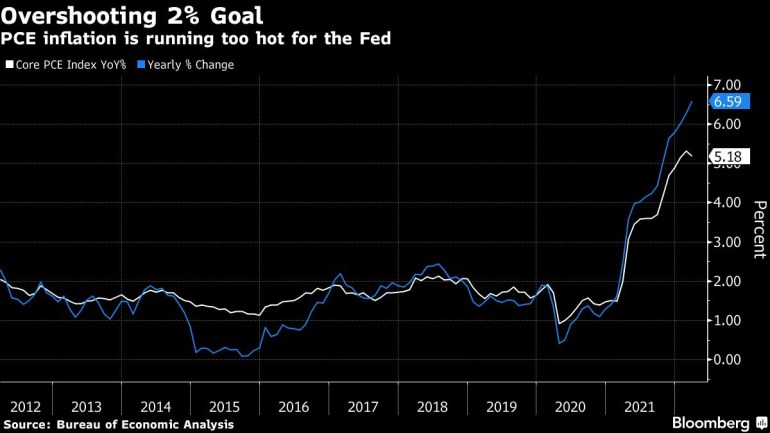

The minutes confirmed that the Fed employees revised up their inflation forecast. They estimated that the private consumption expenditures value index would rise 4.3% in 2022 earlier than decelerating to a 2.5% improve subsequent 12 months.

U.S. central bankers are rapidly pulling again financial stimulus as they try to curb the best inflation charges in many years. Value features have been fueled by low rates of interest, knotted provide chains and better meals and power prices within the wake of Russia’s invasion of Ukraine.

The Fed’s goal for its most popular inflation gauge, the Commerce Division’s private consumption expenditures value index, is 2% a 12 months. The measure rose 6.6% for the 12 months ending March, whereas the Labor Division’s shopper value index rose 8.3% in April.

Excessive inflation has angered Individuals and harm President Joe Biden’s approval rankings, with ire additionally directed on the Fed. Even so, Jerome Powell was confirmed by the Senate to a second time period as chair this month in an 80-19 vote.

To this point, the rise in borrowing prices has but to considerably dent shopper demand. Retail gross sales rose at a strong tempo in April, though with the 30-year mortgage price now above 5%, the tempo of residence gross sales has slowed.

(Provides analyst response in fourth paragraph.)

–With help from Jordan Yadoo, Liz Capo McCormick, Jonnelle Marte and Vince Golle.

Post a Comment