The rise in vitality prices has contributed to rampant inflation, stoking investor issues that development will sluggish.

Oil prolonged 4 weeks of positive aspects amid tight gas provides and a weaker greenback, although elevated costs are fanning issues that the world financial system could also be heading for a recession.

West Texas Intermediate futures topped $111 a barrel whereas gasoline and diesel costs have rallied to information forward of the beginning of the US driving season in a few week. The immediate unfold for Brent crude jumped to a seven-week excessive, with crude provides constricted by the boycott of Russian shipments, and product markets strained as refining capability fails to maintain up with rebounding demand.

The rise in vitality prices has contributed to rampant inflation, prompting central banks to lift charges and stoking investor concern development will sluggish. The Biden administration is contemplating tapping a little-used emergency diesel gas reserve to mitigate the availability crunch amid Russia’s invasion of Ukraine, in line with a White Home official.

The pinnacle of the Worldwide Power Company and India’s oil minister, talking on the World Financial Discussion board in Davos, issued warnings on the chance of excessive costs.

“We might even see costs even going increased, being way more risky and turning into a serious threat for recession for the worldwide financial system,” IEA Govt Director Fatih Birol stated in an interview with Bloomberg TV from Davos.

His sentiments had been echoed by Indian oil and gasoline minister, Hardeep Singh Puri, who stated that a number of of his nation’s neighbors are in “extreme dire straits” due to rallying costs. “Let’s make no mistake: oil at $110 a barrel constitutes a problem for the whole world.”

Oil has surged this 12 months on rising demand and the advanced international fallout from Russia’s invasion. Cash managers have additionally boosted bullish crude bets.

In remarks reported on the weekend, Saudi Arabia signaled it'll proceed to help Russia’s position within the OPEC+ group of producers, undermining US-led efforts to isolate Moscow for its invasion of Ukraine, the Monetary Occasions stated. The dominion hoped to work out an settlement with OPEC+ which incorporates Russia, Power Minister Prince Abdulaziz bin Salman instructed the newspaper.

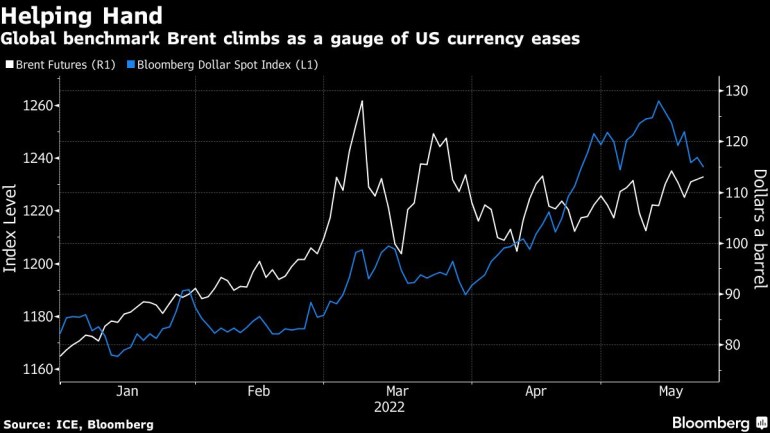

Weaker Greenback

An added carry for crude got here from a weakening greenback, which makes the commodity cheaper for holders of different currencies. The buck was decrease on Monday following a drop of 1.4% final week, probably the most since November 2020.

On the similar time, China has imposed a collection of painful lockdowns to quell Covid-19 outbreaks, hurting Asia’s largest financial system. In Shanghai, officers have laid out the factors to categorize elements of the business hub as low-risk for Covid-19 as they appear to finish a two-month lockdown, with no new circumstances outdoors quarantine being reported. Beijing, nonetheless, reported a document variety of circumstances, reviving concern that the capital could face a lockdown.

Costs:

- WTI for July supply rose 1% to $111.12 a barrel on the New York Mercantile Change at 1:37 p.m. in London.

- Brent for July settlement added 0.8% to $113.48 a barrel on the ICE Futures Europe change.

Oil markets stay in backwardation, a bullish sample that’s marked by near-term costs buying and selling above longer-dated ones. The distinction between WTI’s two nearest December contracts, for this 12 months and in 2023, was close to $13 a barrel, up from about $11 a barrel a month in the past.

Post a Comment