Russian officers are more and more viewing the foreign money’s rebound as an financial menace.

Russia is racing to stem a rally within the ruble and is poised to speed up interest-rate cuts as officers more and more view the foreign money’s rebound as an financial menace.

The most important foreign money appreciation globally was initially touted by the Kremlin as an indication Russia had weathered sanctions over its invasion of Ukraine. However now the features are giving the federal government pause, as they chew into exporter competitiveness and price range income on oil, fuel and different commodities offered overseas.

The foreign money’s appreciation has dominated President Vladimir Putin’s discussions with financial officers, Kremlin spokesman Dmitry Peskov mentioned on a convention name.

“The strengthening of the ruble is a matter for the particular consideration of the federal government,” he mentioned.

An unscheduled interest-rate assembly for Thursday has spurred expectations for a giant discount — and the likelihood that capital restrictions might be loosened additional. The ruble initially held onto features after the announcement, earlier than abruptly swinging to losses of as a lot as 6.6% versus the greenback in afternoon buying and selling in Moscow, ending a five-day surge.

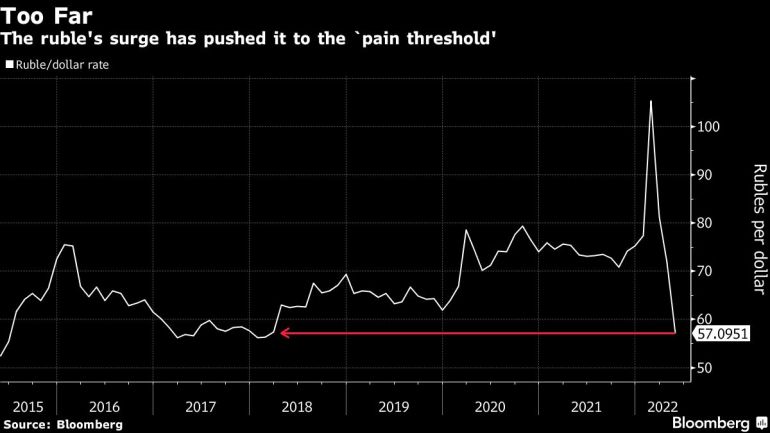

Regardless of the sweeping sanctions imposed on Russia, surging exports and capital controls have sapped demand for international alternate and despatched the foreign money hovering to the best ranges since 2018. Efforts by the authorities to gradual the features, together with two fee cuts in April and the easing of key capital controls earlier this week, up to now haven’t helped.

The Financial institution of Russia didn’t touch upon the choices on the agenda, however officers have mentioned additional fee cuts are probably, pointing to inflation that’s slowed since an emergency fee hike within the days after Russia’s Feb. 24 invasion.

The ruble’s seemingly unstoppable rise amid a flood of vitality earnings and a dearth of imports are fueling bets for a giant reduce.

The benchmark is at the moment at 14%, and TD Securities sees it slashed 300 foundation factors, up from an earlier prediction of 100 foundation factors in June. Oxford Economics predicts a 500 basis-point discount, which might take the speed again into single digits. The median forecast of economists surveyed by Bloomberg is for a 200 basis-point reduce.

Ache Threshold

“There isn't any level in calling an emergency assembly and saying it to the market until they're considering of a big reduce,” mentioned Tatiana Orlova at Oxford Economics. “I wouldn’t even be stunned at a 700 to 800 basis-point reduce.”

The choice is because of be introduced at 10:30 a.m. Moscow time, however with out the standard information convention, the financial institution mentioned. The following scheduled assembly hadn’t been due till June 10.

The ruble’s 30% achieve this 12 months has taken it to “the ache threshold,” mentioned Dmitry Polevoy of Locko Financial institution. Nonetheless, a fee reduce alone “is unlikely to cease the strengthening” as a result of it’s pushed by an enormous commerce surplus, he mentioned.

Coverage makers may use the speed assembly to additional loosen capital controls and permit extra two-way flows within the foreign money, in accordance with TD Securities.

“The foreign money is not a free float and the alternate fee principally displays commerce steadiness flows principally because of Russian exports of hydrocarbons,” mentioned Cristian Maggio, head of portfolio technique at TD Securities in London. “Maybe some restrictions could also be softened on the Russian facet.”

The central financial institution already delivered a bigger-than-forecast reduce of 300 foundation factors at its final assembly in April. It additionally lowered charges by the identical quantity at one other unscheduled assembly earlier that month. That reversed a part of the emergency hike delivered after the assaults began on Ukraine.

“This assembly and the speed reduce are part of the answer, however not the one one,” mentioned Guillaume Tresca, a senior emerging-market strategist at Generali Insurance coverage Asset Administration. “They only need to entrance load the easing and restrict the ruble appreciation. It's a pragmatic strategy.”

Post a Comment