From tech to crypto and past, a number of the days’ greatest losers are investments that when surfed on waves of optimism.

Inventory markets continued to sink following final week’s recession worries, spurred by the Federal Reserve’s charge choice and the risk to world development from China’s continued COVID lockdowns. The worry may very well be seen throughout asset lessons, as merchants offloaded equities and different danger property in favor of money.

Throughout the sea of crimson, a number of the days’ greatest losers have been investments that when surfed on waves of optimism: newly public corporations would outperform; Cathie Wooden’s flagship fund would regain its earlier highs; cryptocurrency would shine as an alternate funding class. On Monday, markets appeared to surrender on all these desires.

“One of many issues that we’ve discovered, at the least on this cycle, is that these speculative growthy disruptive alternate high-risk high-reward asset lessons have been much more charge delicate than perhaps people thought they have been,” stated Steve Chiavarone, senior portfolio supervisor at Federated Hermes.

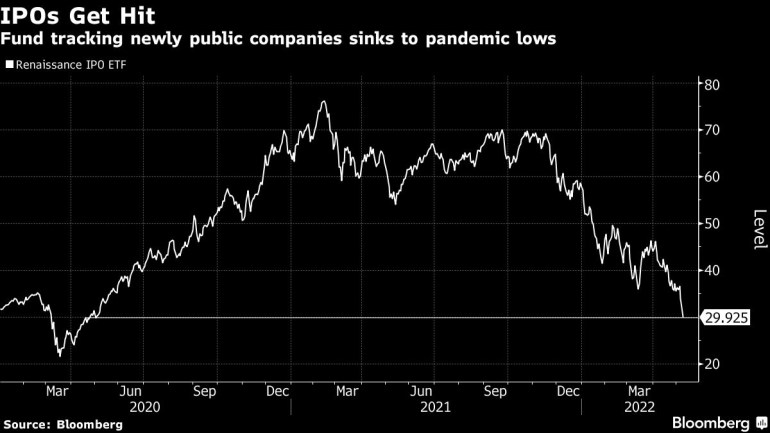

IPOs Deflated

Newly public corporations, lots of that are projected to put up income years down the road nonetheless, have been significantly onerous hit. The Renaissance IPO ETF (ticker IPO) misplaced as a lot as 8.7% on Monday, essentially the most since March 2020. The fund has dropped roughly 50% because the begin of the yr.

For Michael O’Rourke, chief market strategist at Jonestrading, many of those names are “idea shares” that lack profitability and require entry to capital markets to outlive. “As buyers retrench and liquidity dries up, such corporations are at a good better danger,” he stated.

Tech Hit

A Goldman Sachs basket of non-profitable tech corporations dropped greater than 9% at one level Monday. It has misplaced roughly 25% over the previous two weeks alone and is buying and selling at its lowest ranges since Might of 2020.

“Valuations now matter. Traders are demanding income,” stated Peter Boockvar, chief funding officer at Bleakley Advisory Group.

Transformation Trashed

Cathie Wooden’s flagship Innovation ETF (ARKK) skilled its worst month ever in April and its shares are down 51% in 2022. Wooden and her agency, ARK Funding Administration, have been among the many highest-profile victims of the inventory selloff, together with her flagship fund sagging as a lot as 9.3% Monday.

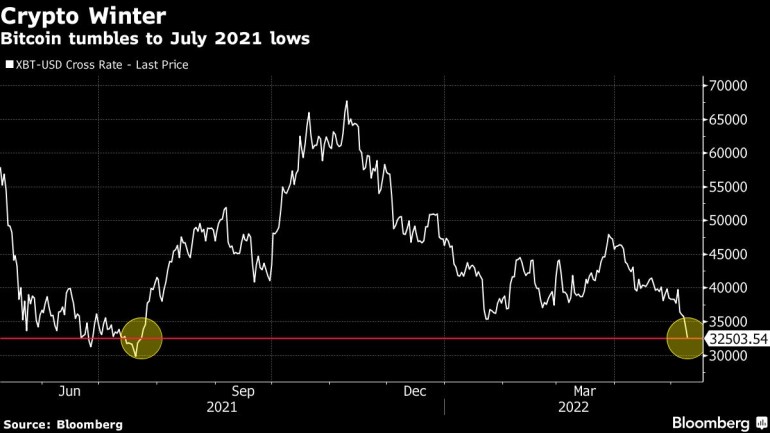

Bitcoin Selloff Accelerates

Bitcoin has additionally been hard-hit, with the digital coin dropping 50% since its November peak to fall under $32,000. The digital token has been down for 5 straight weeks and final week alone misplaced 11%, in response to knowledge compiled by Bloomberg. Different cryptocurrencies have additionally slid, with an index of 100 digital property down roughly 30% because the begin of the yr.

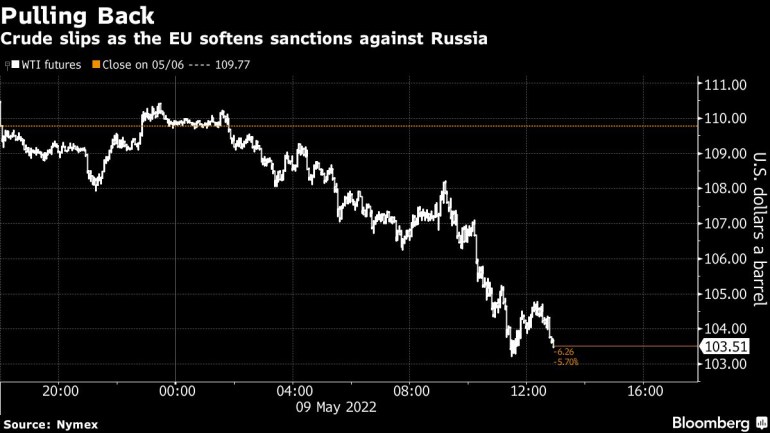

Oil Droop

The power sector was the worst-performing within the S&P 500, falling as a lot as 7.5%. After the European Union stated it could will drop a proposed ban on its vessels transporting Russian oil to third-party international locations, West Texas Intermediate crude sank under $103 a barrel. And Saudi Arabia lowered oil costs for consumers in Asia as coronavirus lockdowns in China lower into demand.

–With help from Vildana Hajric, Denitsa Tsekova, Cecile Gutscher, Elaine Chen and Katie Greifeld.

Post a Comment