Industrial manufacturing rose unexpectedly in Could on easing of COVID curbs however client spending remained weak.

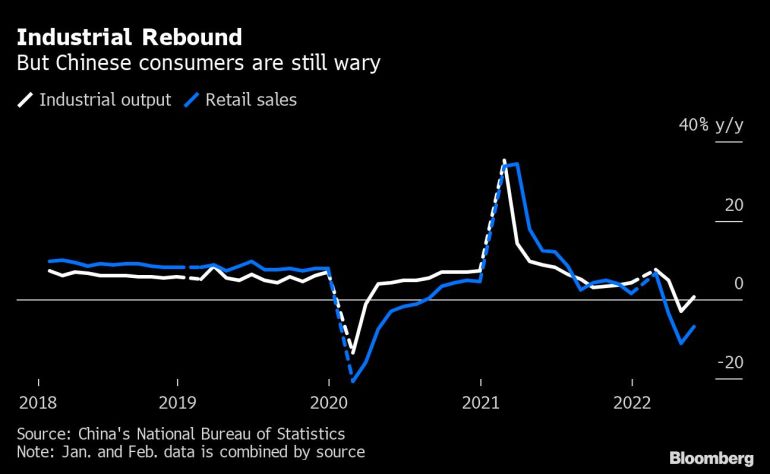

China’s financial system confirmed indicators of restoration in Could after slumping within the prior month, as industrial manufacturing rose unexpectedly. However consumption was nonetheless weak, underlining the problem for policymakers amid the persistent drag from strict COVID curbs.

The info, nevertheless, supplies a path to revitalise development on the planet’s second-biggest financial system after companies and shoppers have been hit laborious by full or partial lockdowns in dozens of cities in March and April, together with a protracted shutdown in business centre Shanghai.

Industrial output grew 0.7 p.c in Could from a yr earlier, after falling 2.9 p.c in April, information from the Nationwide Bureau of Statistics (NBS) confirmed on Wednesday. That in contrast with a 0.7 p.c drop anticipated by analysts in a Reuters information company ballot.

The uptick within the industrial sector was underpinned by the easing of COVID curbs and robust world demand. China’s exports grew at a double-digit tempo in Could, shattering expectations as factories restarted and logistics snags eased.

The mining sector led the best way with output up 7 p.c in Could from a yr in the past, whereas the manufacturing business eked out a meagre 0.1 p.c development, principally pushed by the manufacturing of recent power automobiles which surged 108.3 p.c year-on-year.

“General, our nation’s financial system overcame the hostile affect from COVID [in May] and was exhibiting a restoration momentum,” NBS Spokesperson Fu Linghui informed a press convention, including that he expects the revival to enhance additional in June as a result of coverage assist.

“Nevertheless, the worldwide surroundings remains to be complicated and extreme, with higher uncertainties from outdoors. Our home restoration remains to be at its preliminary stage with the expansion of key indicators at low ranges. The foundations for restoration are but to be consolidated.”

Retail gross sales slipped

That warning was underscored in consumption information, which remained weak as customers have been confined to their properties in Shanghai and different cities. Retail gross sales slipped one other 6.7 p.c in Could from a yr earlier, on prime of an 11.1 p.c contraction the earlier month.

They have been barely higher than the forecast of a 7.1 p.c fall because of the elevated spending on fundamental items reminiscent of grains, oils in addition to meals and drinks.

Trade information confirmed China offered 1.37 million passenger automobiles final month, down 17.3 p.c from a yr earlier, narrowing the decline of 35.7 p.c in April.

Mounted asset funding, a key indicator tracked by policymakers seeking to prop up the financial system, rose 6.2 p.c within the first 5 months, in contrast with an anticipated 6 p.c rise and a 6.8 p.c acquire within the first 4 months.

China’s property gross sales fell at a slower tempo in Could, separate official information confirmed on Wednesday, supported by a slew of easing coverage steps to spice up demand amid the tight COVID-19 curbs.

The federal government has been accelerating infrastructure spending to spice up funding. China’s cupboard has additionally introduced a bundle of 33 measures overlaying fiscal, monetary, funding and industrial insurance policies to revive its pandemic-ravaged financial system.

The nationwide survey-based jobless price fell to five.9 p.c in Could from 6.1 p.c in April, nonetheless above the federal government’s 2022 goal of beneath 5.5 p.c. Particularly, the surveyed jobless price in 31 main cities picked as much as 6.9 p.c, the very best on report.

Some economists count on employment to worsen earlier than it will get higher, with a report variety of graduates getting into the workforce within the subsequent three months.

China has set an annual financial development goal of about 5.5 p.c this yr, however many economists consider that's more and more out of attain.

Chinese language banks prolonged 1.89 trillion yuan ($281bn) in new loans in Could, almost tripling April’s tally and beating expectations. However 38 p.c of the brand new month-to-month loans have been within the type of short-term invoice financing, suggesting actual credit score demand nonetheless stays weak.

The central financial institution on Wednesday saved the medium-term coverage price unchanged for a fifth straight month, matching market expectations.

New lockdown fears loom

Whereas the world’s largest producer reported better-than-expected export development in Could, the subdued exterior demand because of the Ukraine conflict and sturdy manufacturing restoration of Southeast Asian nations threaten the nation’s commerce outlook.

Fears of recent lockdowns additionally loom massive underneath China’s zero-COVID coverage.

One week after the reopening of Shanghai, the native authorities ordered 15 of the town’s 16 districts to undertake mass testing to comprise a leap in circumstances tied to a hair salon.

Authorities in Beijing warned on Tuesday that the town of twenty-two million was in a “race in opposition to time” to familiarize yourself with its most severe outbreak for the reason that pandemic started.

Any potential lockdown and supply-chain disruption dangers amid future COVID-19 outbreaks might constrain the rebound of the financial system as Beijing has proven no signal of easing its zero-COVID coverage, analysts say.

Post a Comment