Russia has failed to fulfill the deadlines as a result of mounting sanctions are chopping off avenues to switch the money.

Russia faces yet one more bond cost check this week, with simply days remaining earlier than it doubtlessly slides into its first international default in a century.

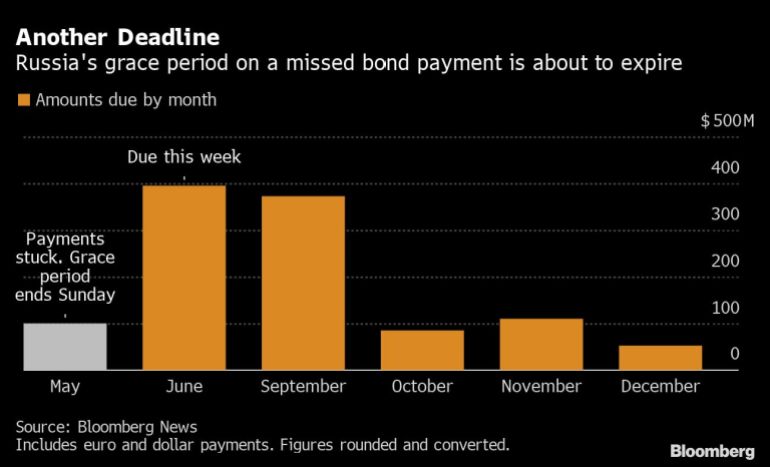

Three curiosity transfers totaling virtually $400 million are due on Thursday and Friday, however extra urgent is a Sunday-night deadline on earlier missed funds from late Could.

These funds — about $100 million of bond coupons — are caught as a consequence of worldwide sanctions, and the grace interval to discover a resolution expires on the finish of the day on June 26. At that time, Russia will successfully be in default, except it in some way will get funds by way of to enough holders of the debt.

It’s not that the federal government lacks the need or the cash to pay. Billions of dollars of vitality income pour into Kremlin coffers every week.

Somewhat, it’s failed to fulfill the deadlines as a result of mounting sanctions are chopping off avenues to switch the money.

The aim within the White Home is to punish the Kremlin’s invasion of Ukraine by sealing its pariah standing available in the market for many years to come back with the nation’s first international default for the reason that Bolshevik revolution greater than a century in the past.

Russia argues that it’s being compelled into default, and tried to search out workarounds. It stated its obligations will probably be deemed to have been fulfilled as soon as cost is made in rubles, in response to a decree signed by President Vladimir Putin setting out a mechanism for servicing the bonds. Earlier, Finance Minister Anton Siluanov had stated the federal government would switch rubles that would then be transformed into foreign currency.

“We’ve completed all the pieces we are able to to guide the horse to water, however it’s lower than us whether or not it desires to drink or not,” Siluanov stated final week.

For the remainder of this week, consideration will probably be on the most recent coupons coming due, and the Finance Ministry’s makes an attempt to pay.

Three coupon funds are due on Thursday and Friday. A failure to pay will set the clock ticking on a grace interval of 30 days for the primary two and 15 enterprise days for the final.

Coupon Shut-Up

First, on June 23, are funds on notes maturing in 2027 and 2047.

Neither has a clause permitting Russia to pay in rubles, however they do permit for various currencies, together with euros, sterling and Swiss francs, bond paperwork present. If the Finance Ministry intends to modify to certainly one of these currencies, it must notify bondholders no less than 5 days upfront.

However just like the coupons which might be caught, these funds should begin their journey to bondholders at Russia’s sanctioned Nationwide Settlement Depository as paying agent. From the NSD, the cash would usually go to worldwide depositories like Euroclear and from there to custodian banks the world over the place particular person bondholders have their accounts.

On June 24, a $159 million cost comes due on a notice maturing in 2028 that has no various choices to the greenback. The possibilities of it going by way of are distant for the reason that US let a Treasury carve-out permitting Individuals to obtain Russia’s sovereign funds expire on Could 25.

What’s extra, the designation on that bond signifies the cost course of would happen by way of monetary infrastructure exterior Russia — with JPMorgan Chase & Co. as paying agent.

Post a Comment