The private consumption worth index, which excludes the unstable meals and gasoline elements, jumped 6.8 % in June in contrast with a 12 months earlier.

US shopper spending barely rose in June after falling within the prior month, underscoring how decades-high inflation has eroded Individuals’ paychecks and tempered demand.

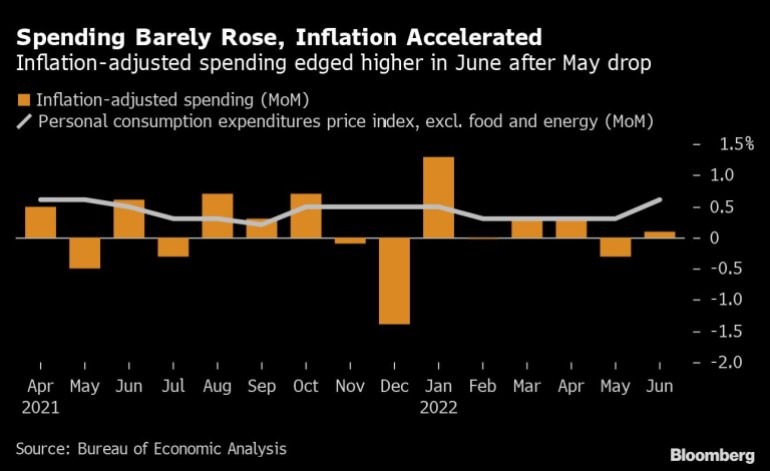

Purchases of products and companies, adjusted for modifications in costs, elevated 0.1% in June after a revised 0.3% drop a month earlier, Commerce Division knowledge confirmed Friday. Spending on companies and merchandise each crept greater.

The private consumption expenditures worth index, which the Federal Reserve makes use of for its inflation goal, rose 1% from a month earlier and was up 6.8% since June 2021. The annual advance was the most important in 40 years.

Excluding meals and power, the value index elevated a larger-than-forecast 0.6%. That was the most important acquire in additional than a 12 months. The core measure was up 4.8% from a 12 months in the past, a slight acceleration from the earlier month.

Inventory futures moved greater after briefly paring positive aspects on inflation issues. Treasury yields have been additionally up barely together with the greenback.

The figures come only a day after separate knowledge confirmed the economic system shrank in back-to-back quarters and underscore how spending energy has deteriorated within the face of surging costs. Individuals’ incomes, whereas rising, are nonetheless not maintaining tempo with fast worth will increase, and that’s left many shoppers with little — if any — leftover money to spend after paying for requirements like fuel, meals and hire.

Decrease Financial savings

The saving fee declined to five.1%, the bottom since 2009, from 5.5% a month earlier, in line with the report.

A current Census Bureau survey confirmed 4 in 10 Individuals say it’s considerably or very troublesome to cowl regular family bills, the highest share for the reason that query was first requested in August 2020.

The Fed is set to deliver down inflation, and fears are mounting on whether or not the central financial institution’s actions, which have already slowed house gross sales, will tip the economic system right into a recession.

Whereas inflation-adjusted outlays for companies rose 0.1%, the acquire was the smallest this 12 months. Spending on merchandise posted an identical advance but it surely adopted a 1.6% droop within the prior month.

Unadjusted for inflation, spending rose 1.1% from the prior month, whereas private revenue elevated 0.6% for a second month.

Companies have already observed modifications in shopper conduct as inflation erodes employees’ discretionary incomes. McDonald’s Corp. says it’s seeing clients commerce right down to its worth choices, and Walmart Inc. says receipts are tilted extra towards meals and away from normal merchandise like attire.

And whereas the labor market up to now continues so as to add jobs at a wholesome tempo, a slew of tech firms have introduced layoffs or plans to gradual hiring. Any vital broadening in such conduct throughout sectors would add to issues of an imminent downturn and assist form financial coverage within the coming months.

Earlier this week, the Fed raised rates of interest by one other 75 foundation factors and coverage makers stated they anticipate “ongoing will increase” will likely be acceptable. Although how a lot relies on how the economic system performs, stated Fed Chair Jerome Powell.

“Restoring worth stability is simply one thing that we now have to do,” Powell stated throughout a press convention Wednesday.

In the meantime, a intently watched measure of wages and advantages — the employment price index — climbed within the second quarter by greater than forecast. The Labor Division’s report Friday confirmed a 1.3% advance, heightening issues inflation will stay persistently excessive.

The buyer worth index, which usually runs hotter than the PCE worth index, jumped to a contemporary 40-year excessive of 9.1% in June. Earlier this week, Powell stated the PCE gauge is a greater measure of inflation.

Wages and salaries elevated 0.5% in June. When adjusted for inflation, nonetheless, disposable private revenue dropped 0.3%, essentially the most in three months.

(Provides graphic)

–With help from Kristy Scheuble.

Post a Comment