Coverage makers are assessing results of curiosity hikes this 12 months on cooling value development, amid an unprecedented financial disaster.

The Central Financial institution of Sri Lanka (CBSL) has stored its key charges regular, a extensively anticipated transfer because it awaits the impact of previous hikes to trickle by the economic system whereas a fall in world commodity costs can be anticipated to appease home inflation.

The Standing Lending Facility fee stayed at 15.5 p.c on Thursday, whereas the Standing Deposit Facility Fee remained at 14.5 p.c.

Eleven out of 15 economists and analysts polled by the Reuters information company had anticipated charges to stay unchanged.

The central financial institution has raised charges by a file 950 foundation factors thus far this 12 months to battle excessive inflation in Sri Lanka, which is wilting beneath a extreme financial disaster.

A overseas trade scarcity has left the federal government struggling to pay for important imports of gas, fertilisers, meals and medication.

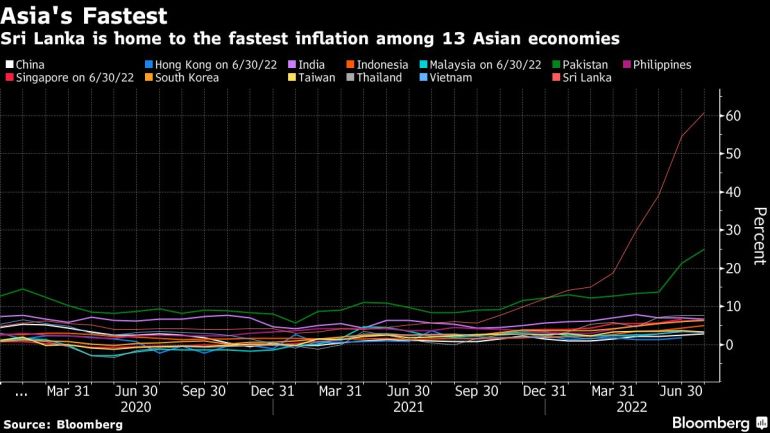

Inflation hit 60.8 p.c year-on-year in July, and meals prices expanded by a searing 90.9 p.c, in keeping with the newest authorities knowledge.

“In arriving at this resolution, the board thought-about the newest model-based projections, which level in direction of a bigger than anticipated contraction in exercise and a sooner than anticipated easing of value pressures,” CBSL mentioned in an announcement.

The financial institution mentioned the measures taken by it and the federal government thus far would assist comprise combination demand pressures whereas an anticipated decline in world commodity costs would cross by to home costs.

“Given the dynamic disaster scenario, going forward will probably be necessary to see if these preliminary indicators of stabilisation proceed within the optimistic path the CBSL foresees, supported by progress on the IMF and debt restructuring negotiations,” mentioned Thilina Panduwawala, head of analysis at Frontier Analysis.

The central financial institution mentioned the impact of persistent provide facet disruptions, primarily resulting from shortages of energy and vitality, and uncertainties related to socio-political developments are anticipated to have precipitated “important hostile results” on financial development within the second quarter.

Tens of 1000's of individuals protesting towards the financial disaster pressured the resignation of then-President Gotabaya Rajapaksa in July. He was changed by veteran politician Ranil Wickremesinghe.

The central financial institution mentioned development was more likely to stay subdued within the third quarter as nicely.

Analysts mentioned the economic system will endure a steep contraction this 12 months.

“Our GDP [gross domestic product] forecasts stay unchanged at a 7.5 percent-9 p.c contraction at this level. The 2Q and 3Q will certainly be the worst hit. The steepest is more likely to are available in 2Q given the political tensions and gas shortages seen in June and July,” mentioned Lakshini Fernando, a macroeconomist with Asia Securities.

Post a Comment