A pullback in American shopper spending is a essential factor within the Federal Reserve’s combat towards inflation.

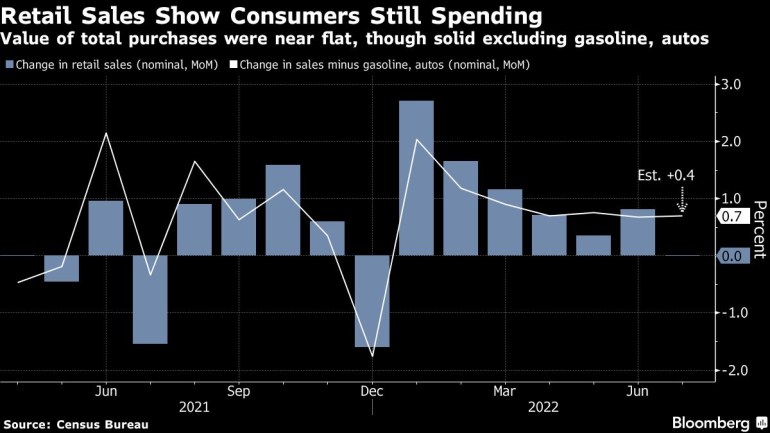

US retail gross sales stagnated final month on declines in auto purchases and gasoline costs, although positive factors in different classes urged shopper spending stays resilient.

The worth of general retail purchases was flat final month after a revised 0.8% leap in June, Commerce Division knowledge confirmed Wednesday. Excluding gasoline and autos, retail gross sales rose a better-than-expected 0.7%. The figures aren’t adjusted for inflation.

The median estimate in a Bloomberg survey of economists known as for a 0.1% rise in retail gross sales.

For a lot of People, the numerous pullback in gasoline costs has boosted sentiment and certain freed up money to spend elsewhere. Even so, widespread and persistently excessive inflation is eroding staff’ paychecks and forcing many to lean on on bank cards and financial savings to maintain up. That presents a permanent headwind to the resilience of customers within the months forward.

Gross sales at gasoline stations fell 1.8% in July, reflecting a gentle retreat in gasoline costs from the report highs seen in mid-June. Purchases at motorcar and elements sellers dropped 1.6%.

Broad Will increase

Meantime, gross sales picked up elsewhere. 9 of the 13 retail classes confirmed will increase final month, in accordance with the report, together with constructing materials shops, nonstore retailers and electronics. Previous to July, general retail gross sales had risen each month this 12 months.

A pullback in shopper spending — the primary engine of US development — is a essential factor within the Federal Reserve’s inflation combat. Coverage makers are looking for to chill the economic system sufficient to tame value will increase, however not a lot as to trigger a recession or drive a surge in unemployment. Wednesday’s report is one in every of many knowledge factors the central financial institution will take into account when deciding the dimensions of one other price hike subsequent month.

Treasury yields held positive factors and US inventory futures remained decrease after the information, which urged shopper discretionary spending is stable sufficient to maintain the Ate up a path of aggressive interest-rate hikes.

Earnings out this week have additionally make clear the well being of US customers. After slashing its outlook a number of weeks in the past, Walmart Inc. mentioned outcomes improved greater than anticipated in late July due to sturdy back-to-school gross sales, decrease gasoline costs and extra shopping for by wealthier clients looking for bargains — a possible byproduct of inflation. House Depot Inc. earnings beat estimates, however buyer transactions fell for a fifth-straight quarter.

Goal Corp., nonetheless, missed even the bottom revenue estimates as the corporate reduce costs on dwelling home equipment, patio furnishings and different discretionary gadgets to right-size stock.

Grocery retailer gross sales have been up 0.2%, seemingly reflecting rising meals costs fairly than a major uptick in buying exercise. Information out final week confirmed the price of groceries has surged 13.1% within the final 12 months, essentially the most since 1979. Gross sales at eating places and bars, the one providers’ element within the report, climbed 0.1%, the weakest print since a decline in January.

The retail gross sales report primarily focuses on items, not providers. Shoppers have been shifting again towards pre-pandemic spending patterns, which leans extra on providers like leisure and journey, and away from the merchandise-heavy tilt of the previous two years. A fuller image of spending in July, which incorporates each providers spending and inflation-adjusted figures, shall be launched later this month.

Gross sales receipts at nonstore retailers — which incorporates e-commerce — climbed 2.7%. Amazon.com Inc.’s Prime Day, which occurred mid-month, seemingly performed a task. The occasion was the largest on report, in accordance with the corporate, as members purchased greater than 300 million gadgets globally.

So-called management group gross sales — that are used to calculate gross home product and exclude meals providers, auto sellers, constructing supplies shops and gasoline stations — have been up a better-than-forecast 0.8%, matching the strongest since January.

–With help from Jordan Yadoo and Brendan Case.

Post a Comment