The buying and selling phenomenon that noticed particular person traders inflate inventory costs regardless of firm efficiency is again.

Meme inventory mania, born through the peak of the coronavirus pandemic, has turned the tables on institutional traders by banding retail day merchants collectively by way of social media to pump the inventory of corporations Wall Road bets towards.

This new era of merchants, assembling on web sites like Reddit’s in style WallStreetBets discussion board and utilizing commission-free buying and selling apps like Robinhood, made headlines after they catapulted the inventory value of flailing online game retailer GameStop.

Shares surged from $3 in 2020 to previous $300 on the finish of January 2021, inflicting historic market volatility and substantial losses for short-selling hedge funds.

Jamie Rogozinski, the founding father of in style on-line inventory market chat discussion board WallStreetBets, which boasts 12.5 million members on Reddit, instructed Al Jazeera that retail merchants have been simply reacting to the occasions. “The federal government compelled everybody house, despatched them stimulus cheques, took away folks’s leisure, their sports activities, their every part. The pure development was for folks to show to shares and buying and selling.”

Retail traders who've engaged within the meme inventory frenzy are recognized for concentrating on struggling companies, and there may be good cause for that, defined Edward Moya, a senior market analyst at OANDA.

“The retail dealer has been looking for alternatives to stay it to the hedge funds,” he instructed Al Jazeera.

What's a meme inventory?

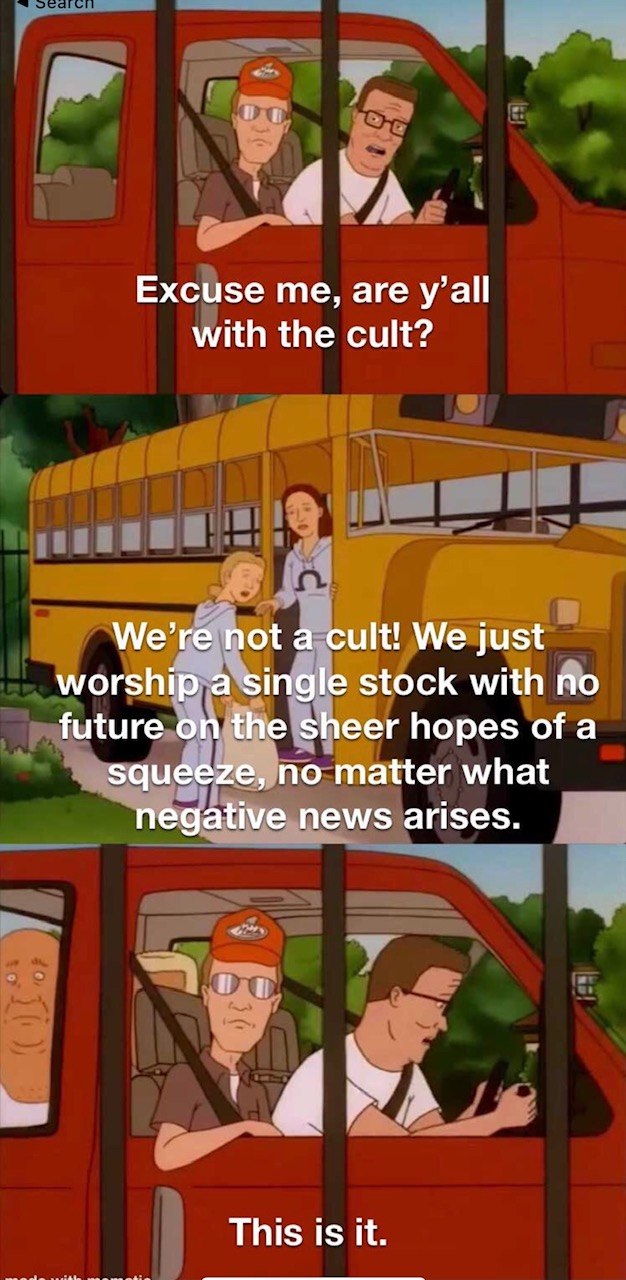

A meme inventory is one which turns into well-known amongst particular person traders because of social media.

A bunch of day merchants on a social media website equivalent to WallStreetBets identifies the inventory and coordinate with others inside their on-line neighborhood to purchase shares to inflate its value with the intention of promoting it earlier than it falls. They often goal corporations that Wall Road has wager towards. The rise in inventory value often has little to do with the corporate’s efficiency.

When did meme shares change into a factor?

The meme inventory frenzy made headlines in January 2021 with online game firm GameStop. Day merchants organising on Reddit prompted the inventory to soar. The merchants gained plenty of consideration as a result of they prompted Wall Road institutional traders, many short-selling hedge funds, to lose tens of millions of dollars.

What is brief promoting?

Quick promoting is borrowing a inventory by way of a dealer with the expectation the value will fall. When it does, the client returns it and earnings from the distinction between the primary value and the second, cheaper price.

What’s a brief squeeze?

A brief squeeze is when traders who've wager towards a inventory with the idea that it's going to fall, see the value rise. So when Reddit’s WallStreetBets asks retail day merchants to purchase GameStop inventory, thereby driving the value increased, hedge funds caught in a brief squeeze can both shut out their bets and eat their losses or attempt to experience out the value surge which often means they should put up more cash.

How do meme inventory merchants choose the businesses they aim?

Rogozinski of WallStreetBets explains the technique: “They've a rival, the large dangerous hedge funds which might be shorting and attempting to eliminate their beloved, within the case with GameStop it was online game firm, one thing that this demographic relates [to]. So you've gotten this very nice story of fine and evil. David and Goliath. This online game retailer, I find it irresistible, I grew up enjoying Mario Brothers and I’m not going to allow you to take it away.”

Has Wall Road taken benefit of the meme inventory buzz?

Sure. Analysts say that Wall Road is making a revenue even when the preliminary meme inventory frenzy took a little bit of getting used to.

“In some circumstances, it’s been straightforward cash,” OANDA’s Moya defined. “When meme shares began to evolve, you had all of the hedge funds say, ‘OK, I don’t consider on this technique, there’s a lot alternative right here to make the most of getting in, possibly not essentially earlier than the retail merchants, however getting out earlier than them. That’s the place the cash is.”

Has meme buying and selling advanced prior to now yr and a half?

With document excessive inflation and a doable recession on the horizon, retail merchants are altering their behaviour, Moya instructed Al Jazeera.

“They’re actually type of attempting to change into extra a pump-and-dump scheme,” he mentioned. “This isn't what we noticed earlier than the place folks have been saying they’re gonna maintain GameStop eternally or AMC eternally. Now it’s extra of a focused strategic wager.”

Are folks really being profitable off meme shares?

Simply as with every funding, it depends upon the timing of what you obtain and offered. Some particular person traders made nice positive factors in GameStop, whereas those that have it now can be working at a loss.

“Should you have been to pick out an individual who held a place in GameStop at random on the frenzy’s peak, it's not apparent that that individual made cash over the course of the GameStop episode. A lot of folks stored holding the inventory on precept far longer than they need to have,” Alex Chinco, professor of finance at Baruch School, instructed Al Jazeera.

Why the resurgence in meme shares now?

Widespread inflation has made everybody loads poorer, OANDA’s Moya defined to Al Jazeera.

Millennials and Era Z are shopping for homes, have a tonne of pupil loans to pay again, and can't afford to be unfastened with their monetary investments. However in the identical vein, retail buying and selling round meme shares gives a possibility to go towards the grain. And “with a lot pessimism round Wall Road, plenty of younger persons are not anticipating the inventory market to offer as many alternatives for long-term bullish bets”, Moya added.

Rogozinski added: “There may be this mindset of the do-it-yourself social media influencers and it’s additionally in regards to the gig financial system, the place folks have a job they usually’re nonetheless doing hustles on the aspect. You've got these folks saying, ‘I don’t must pay any individual else to regulate my cash’.”

Have meme shares affected the broader market?

It appears like Wall Road could also be catering to this new crowd.

“The New York Inventory Trade and international markets corporations are beginning to create derivatives and merchandise which might be cheaper and smaller,” Rogozinski mentioned. “They’re making small variations of futures, micro-stock choices, that are a tenth as leveraged so it’s not as harmful. There’s actually no monetary justification for these merchandise to exist, apart from to make issues extra accessible to this specific demographic.”

Is anybody regulating these things?

The Securities and Exchanges Fee (SEC), the US federal regulatory company, has seemed into meme shares and Congress held a listening to on it, however to date no motion has come of it.

In June 2022, the US Home Committee on Monetary Providers printed its findings in a report (PDF), warning of the insufficient threat administration which led as much as the meme inventory buying and selling frenzy. The committee additionally known as on regulators to spice up capital and liquidity oversight, enhance supervision of retail-facing “superbrokers” and attempt to higher perceive how retail merchants function.

Post a Comment