And the way does he plan to avoid wasting the UK’s imperilled financial system?

London, United Kingdom – In some methods, Kwasi Kwarteng’s elevation to the second-most essential job in British politics couldn’t be extra novel. In others, it couldn’t be extra typical.

Born in London in 1975 to Ghanaian dad and mom who had emigrated to the United Kingdom as college students within the Nineteen Sixties, Kwarteng has damaged new floor in turning into the primary Black particular person to carry the function of chancellor of the Exchequer.

However the path he adopted to 11 Downing Avenue is properly worn.

He studied at Eton Faculty and the College of Cambridge – among the many nation’s most elite establishments – and has labored within the media and finance.

“Some individuals would say that he’s had a standard rise to the highest, from [fee-paying] public college by an elite college to the Conservative [Party] … after which a prime cupboard job,” Tim Bale, a professor of politics on the Queen Mary College of London, advised Al Jazeera.

“And so far as his place goes, he's very a lot on the neoliberal proper of the Conservative Social gathering, he's a market fundamentalist.”

The journey into politics

After graduating, he labored as a columnist for the UK’s conservative-leaning Every day Telegraph newspaper – a job as soon as additionally held by the scandal-hit former premier Boris Johnson – earlier than shifting into banking as a monetary analyst with the American funding agency JP Morgan.

In 2000, he returned to Cambridge to finish a PhD in financial historical past, and turned his consideration to politics.

In 2010, Kwarteng was elected to the Home of Commons as a part of a brand new consumption of Conservative Social gathering politicians, together with now-Prime Minister Liz Truss and different politicians who would go on to take pleasure in a excessive profile, together with Dominic Raab, Priti Patel and Sajid Javid.

Whereas he earned a repute amongst colleagues as a rising star, Kwarteng was compelled to attend a number of years for his first ministerial place, as others moved forward rapidly.

Throughout that point, he accustomed himself to the reduce and thrust of Westminster politics and wrote a number of books on topics together with finance, former Conservative chief Margaret Thatcher and British imperialism.

He additionally co-authored Britannia Unchained, a set of essays by a number of Conservative MPs, together with Truss, which criticised British employees for being “among the many worst idlers on the planet” and denounced the UK’s “bloated state, excessive taxes and extreme regulation”.

Kwarteng’s long-anticipated promotion finally got here in 2017, when he was made parliamentary personal secretary to then-Chancellor Phillip Hammond.

Since, he has steadily climbed the political ladder, holding roles as a minister on the Division for Enterprise, Vitality and Industrial Technique and enterprise secretary.

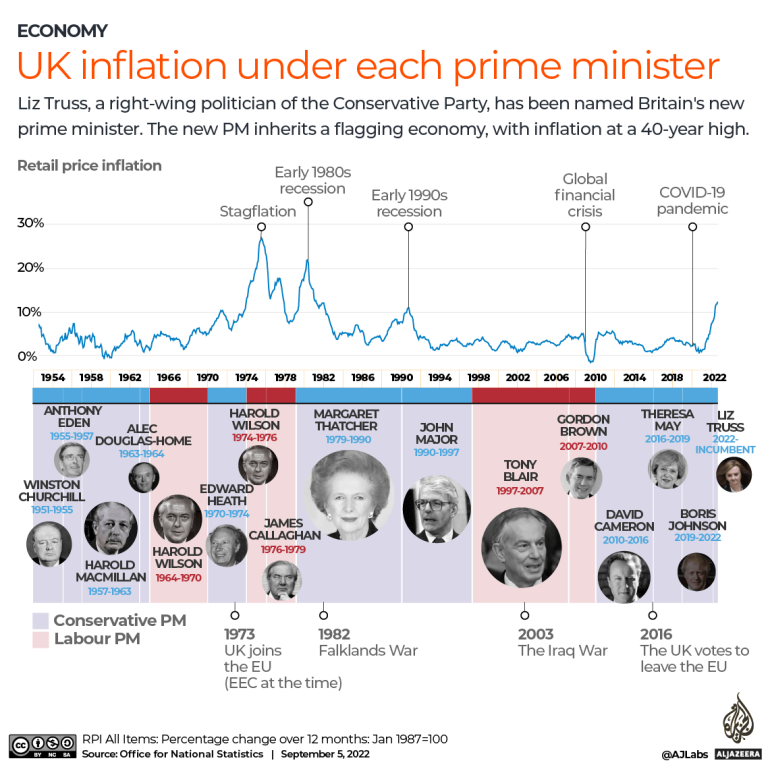

Now, as chancellor, Kwarteng finds himself in control of an ailing UK financial system beset by hovering inflation and a cost-of-living disaster.

“This can be a once-in-a-lifetime disaster,” Jeevun Sandher, head of economics on the New Economics Basis think-tank, advised Al Jazeera. “It's presumably probably the most critical set of circumstances which have confronted any chancellor because the second world warfare.”

Give attention to progress

Kwarteng will reveal his plan for fixing the nation’s funds on Friday when he'll introduce a “mini” funds to the Home of Commons setting out the federal government’s fiscal priorities.

He's anticipated to offer additional particulars on a sweeping intervention within the power market, which has been roiled by Russia’s invasion of Ukraine. The transfer is predicted to price as a lot as 150bn kilos ($170bn).

Kwarteng can be reportedly making ready to announce tens of billions of kilos value of tax cuts, together with a reversal of the rise in nationwide insurance coverage contributions launched by Johnson’s administration, cancelling a deliberate enhance in company tax from 19 to 25 % and slashing stamp responsibility charges for these shopping for properties.

His intentions have been clearly signalled.

In an open letter printed by the Monetary Occasions forward of his appointment as chancellor, Kwarteng mentioned Truss’s administration had “two pressing duties” – to assist people and companies dealing with “extreme worth shocks”, together with sharp upticks of their gasoline and electrical energy payments, and to spice up financial progress.

“Motion is required to get households and companies by this winter and the following,” he wrote, including it was crucial to “lay the groundwork” for long-term change.

“This implies reducing taxes, placing a refund into individuals’s pockets and unshackling our companies from burdensome taxes and unsuitable laws.”

Kwarteng’s self-described “unashamed” emphasis on progress has additionally seen him put banking bosses on discover that he desires to engineer a “Massive Bang 2.0” for the Metropolis of London to intensify competitors within the UK’s monetary sector, which accounts for 8.3 % of its complete financial output.

He's reportedly contemplating scrapping a cap on bankers’ bonuses launched by the European Union in 2014.

The curb, adopted by the UK when it was but a member state, meant bonuses had been restricted to not more than 100% of an worker’s wage, or double that with shareholder approval.

Critics have mentioned the cap proved ineffective, with banks merely growing salaries.

‘The overwhelming majority are going to lose out’

Total, Kwarteng’s imaginative and prescient has echoes of the trickle-down, neoliberal financial insurance policies pursued by earlier Conservative governments, together with the one led by Thatcher from 1979-1990.

“[Kwarteng] believes within the state getting out of the best way and in Britain maximising its important comparative benefit which he sees because the Metropolis of London and finance,” Bale mentioned.

“[But] presumably, along with his financial historical past background, he has bought a good concept of what hasn’t labored previously.

“So it appears barely unusual that he’s taking this very radical, tax-cutting leads on to progress strategy, since there’s little or no proof for that, both within the UK or on the planet as a complete.”

With an election anticipated in 2024, Kwarteng will probably be hoping his measures present indicators of benefitting the financial system rapidly.

However critics, together with Sandher, argue his technique will solely enhance inequality, serving to “the wealthy get richer” whereas individuals on low to center incomes proceed to battle.

“They [Truss’s government] know they've one roll of the cube,” Sandher mentioned.

“By way of a big gamble … no matter what occurs, it is rather clear that the British individuals will lose. They won't have the funding they want for the long run and they won't be [lifted] out of the cost-of-living disaster.

“The financial end result goes to be that the overwhelming majority are going to lose out, and the highest one % are going to win.”

Post a Comment