The transfer can spur a restoration in oil costs which have dropped to about $90 from $120 three months in the past.

OPEC+ has agreed its deepest cuts to grease manufacturing for the reason that 2020 COVID pandemic at a Vienna assembly, curbing provide in an already tight market regardless of stress from the USA and others to pump extra.

Wednesday’s transfer by the worldwide cartel of oil-producing international locations may spur a restoration in oil costs. which have dropped to about $90 from $120 three months in the past on fears of a world financial recession, rising US rates of interest and a stronger greenback.

Al Jazeera’s Dominic Kane, reporting from Berlin, stated the impact of the choice is anticipated to take three weeks to be mirrored on the patron costs.

He additionally stated that “some analysts recommend that the US would possibly search to release among the shares of oil that it holds to attempt to counteract what OPEC+ is making an attempt to do”.

The US had pushed OPEC to not proceed with the cuts, arguing that fundamentals don't help them, a supply accustomed to the matter instructed the Reuters information company.

Sources stated it remained unclear if cuts may embrace extra voluntary reductions by members resembling Saudi Arabia, or if they might embrace present under-production by the group.

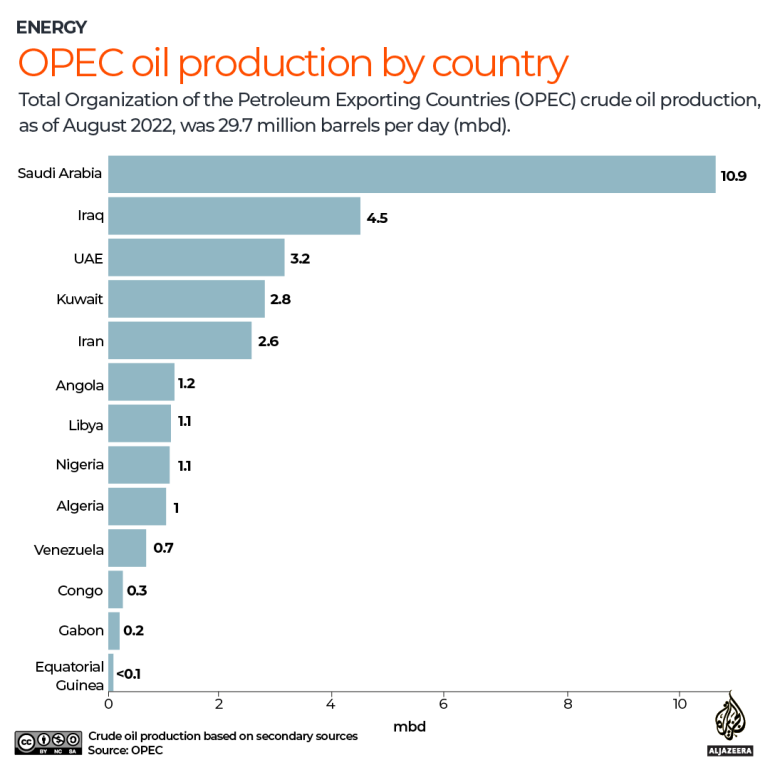

OPEC+ fell about 3.6 million barrels per day in need of its output goal in August.

“Larger oil costs, if pushed by sizeable manufacturing cuts, would probably irritate the Biden Administration forward of US mid-term elections,” analysts of Citi, the main world financial institution, stated in a word.

“There might be additional political reactions from the US, together with extra releases of strategic shares, together with some wildcards together with additional fostering of a NOPEC invoice,” Citi stated, referring to a US antitrust invoice towards OPEC.

JPMorgan funding financial institution additionally stated it anticipated Washington to place in place countermeasures by releasing extra oil shares.

Saudi Arabia and different members of OPEC+, which teams the Group of the Petroleum Exporting Nations and different producers together with Russia, have stated they search to forestall volatility quite than to focus on a specific oil value.

Benchmark Brent crude rose in the direction of $93 per barrel on Wednesday, after climbing on Tuesday.

Weaponising vitality

The West has accused Russia of weaponising vitality, making a disaster in Europe that might set off gasoline and energy rationing this winter.

Moscow accuses the West of weaponising the greenback and monetary methods, resembling SWIFT, in retaliation for Russia sending troops into Ukraine in February.

The West accuses Moscow of invading Ukraine, whereas Russia calls its actions a particular army operation.

A part of the explanation Washington desires decrease oil costs is to deprive Moscow of oil income, whereas Saudi Arabia has not condemned Moscow’s actions.

Relations have been strained between the dominion and the administration of Biden, who travelled to Riyadh this 12 months however did not safe any agency cooperation commitments on vitality.

“The choice is technical, not political,” United Arab Emirates Minister of Power Suhail al-Mazroui instructed reporters forward of the assembly.

“We won't use it as a political organisation,” he stated, including that issues a few world recession can be one of many key matters.

Russian Deputy Prime Minister Alexander Novak, who was placed on the US particular designated nationals sanctions listing final week, additionally travelled to Vienna to take part in conferences. Novak shouldn't be below EU sanctions.

Post a Comment