Chinese language President Xi Jinping is presiding over a brand new period that prioritises political management over financial improvement.

Taipei, Taiwan — When Xi Jinping took the helm of the Chinese language Communist Social gathering (CCP) 10 years in the past, he pledged to work exhausting to fulfill the individuals’s expectations for a greater commonplace of life.

“Our individuals love life and count on higher training, extra steady jobs, higher revenue, extra dependable social safety, medical care of a better commonplace, extra comfy residing situations, and a extra stunning setting,” Xi stated in a speech on the 18th Nationwide Social gathering Congress in November 2012.

“The individuals’s craving for a great and exquisite life is the aim we should attempt for.”

Now, Xi, who seems set to safe an unprecedented third time period on the twentieth CPP Congress that begins on Sunday, faces the duty of delivering rising residing requirements for 1.4 billion Chinese language individuals because the financial system confronts its stiffest challenges in a long time.

Xi’s mandate, which successfully units him up as chief for all times, solidifies a brand new period for China, the world’s second-largest financial system, through which pragmatic policy-making targeted on financial improvement more and more takes a backseat to nationalism and political management. As essentially the most highly effective Chinese language chief since Mao Zedong, Xi has revived personalistic rule and departed from the pro-market insurance policies that had prevailed since key financial reforms of the Eighties.

Whereas the CCP’s legitimacy has for many years been strongly linked to financial efficiency, together with enormous positive factors in residing requirements and reductions in poverty, Xi has reasserted state management over the financial system, initiating heavy-handed and widespread crackdowns on the personal business which have hampered progress and sapped investor confidence.

After rising by practically three-quarters throughout Xi’s first 9 years in energy, China’s $18 trillion financial system is slowing sharply as a deflating home bubble, COVID-19 lockdowns, financial decoupling from the West and a looming demographic disaster threaten to hobble progress within the a long time forward.

“The problem for Xi over the long term is how does China’s financial system now preserve a sustainable progress charge?” Andy Mok, a senior analysis fellow on the state-backed Heart for China and Globalization, instructed Al Jazeera.

“China’s days of exceptional eight p.c plus GDP progress are over, however is it nonetheless attainable to maintain 4 or 5 p.c?”

China’s Ministry of International Affairs didn't reply to a request for remark.

For many of Xi’s rule, China’s financial system grew strongly, albeit at a slower tempo than the double-digit expansions of the early Nineteen Nineties and mid-2000s. Annual progress ranged between six and eight p.c from 2012 to 2019, in keeping with World Financial institution information, whereas the gross home product (GDP) per capita roughly doubled between 2012 and 2021, from $6,300 to $12,500.

For the reason that arrival of COVID-19, progress has been unstable, crashing to 2.2 p.c in 2020 earlier than rebounding to eight.1 p.c final yr. China’s ongoing use of lockdowns and border restrictions as a part of its ultra-strict “zero COVID coverage has all however ensured this yr’s financial efficiency can be lacklustre at greatest. The World Financial institution has projected 2.8 p.c progress for this yr, which might be the worst lead to a non-pandemic yr since 1990.

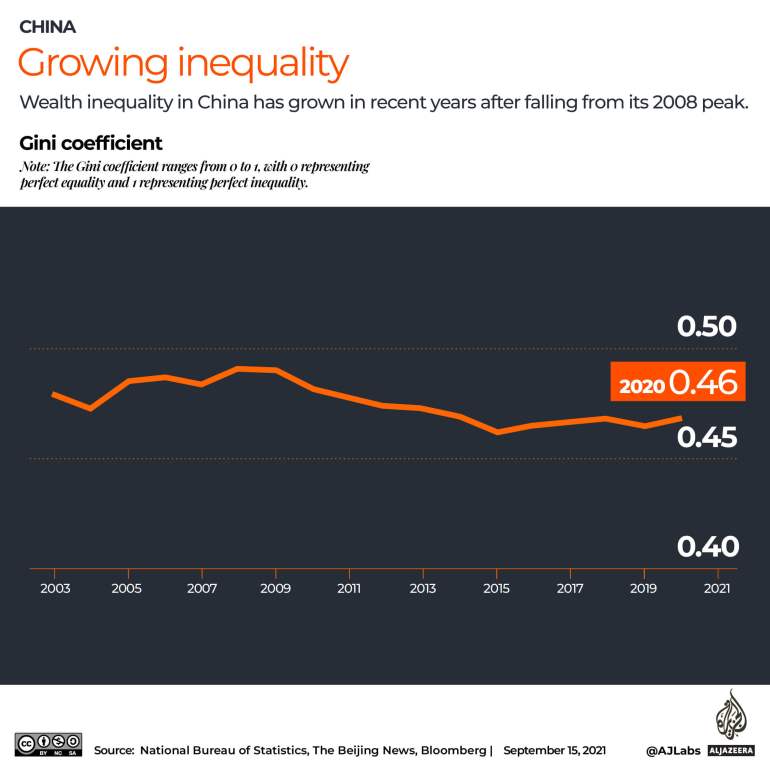

Inequality, which Xi has promised to deal with underneath his drive for “frequent prosperity,” has remained excessive and roughly fixed all through the last decade, with the Gini coefficient hovering between 0.46 and 0.47 – the place 0 represents prefect equality and 1 represents good inequality – considerably above the OECD common.

Different key financial indicators have stayed comparatively constant, with inflation staying underneath three p.c from 2012 by to 2021, and unemployment remaining underneath 5 p.c, in keeping with World Financial institution information.

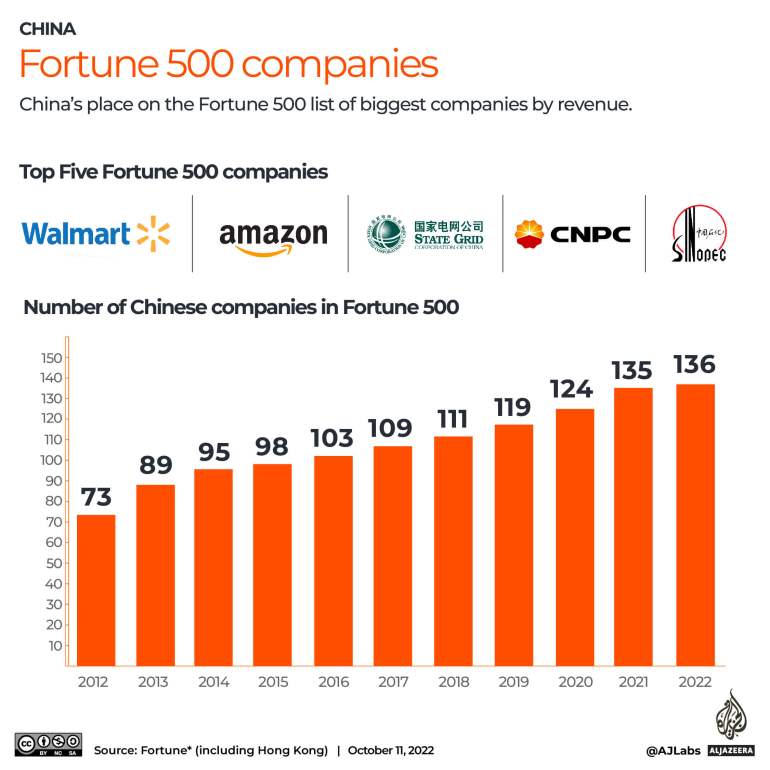

In the meantime, Chinese language firms have risen to turn out to be a number of the world’s greatest companies, with tech giants comparable to Alibaba, Xiaomi and Tencent turning into globally recognised names. This yr’s Fortune 500’s checklist of the world’s greatest firms consists of 136 Chinese language companies, in contrast with 73 in 2012.

“In Xi’s first five-year time period, the Chinese language financial system reached its progress targets and remained resilient. The second time period was extra of a blended image, China’s financial system hit some very robust headwinds, and a few setbacks have been self-inflicted,” Wang Xiangwei, a columnist and former editor-in-chief for the Hong Kong-based South China Morning Put up newspaper, instructed Al Jazeera.

“Sadly, proper now Beijing is sending a message that politics is above all else,” Wang stated.

For a lot of China watchers, the nineteenth CCP Congress in 2017 marked a watershed for the nation’s political and financial trajectory. On the Congress, Xi heralded a “New Period” for Chinese language socialism and enshrined his private ideology, Xi Jinping Thought, within the structure. A number of months later, Xi secured the celebration’s blessing to abolish time period limits.

Xi then launched the “frequent prosperity” coverage at a CCP central committee assembly in October 2020, directing celebration officers to deal with gaps in regional improvement, the urban-rural divide and revenue inequality.

The next yr noticed a sweeping crackdown on personal industries, from property and training to pc gaming. The tech sector was hit significantly exhausting, with China’s 10 greatest tech companies dropping $2 trillion in market capitalisation over a twelve-month interval.

Dramatic occasions like ride-hailing app Didi’s botched IPO and the disappearance of Alibaba’s founder Jack Ma have been acquired as a transparent message to China’s entrepreneurs — the heady days of exponential earnings aren't any extra. By the tip of 2021, 49 of China’s 100 greatest listed firms have been personal companies, down from 53 in 2020. The dip marked the primary decline within the personal sector’s share of the company house since 2014.

“Xi Jinping has modified China’s financial course dramatically from ‘progress in any respect value’ to ‘frequent prosperity,’ specializing in redistributing revenue and wealth extra equally,” Diana Choyleva, chief economist at Enodo Economics, instructed Al Jazeera.

China’s overleveraged property market has felt the impact of a ensuing crackdown on hypothesis and reckless lending. New house costs in 70 cities throughout China have fallen greater than two p.c previously yr. For the Chinese language financial system, the bursting bubble poses monumental dangers. Partly resulting from restrictions on different asset lessons, actual property has turn out to be the popular funding automobile for China’s aspiring center class — as a lot as 70 p.c of China’s family wealth is tied up in housing.

Choyleva stated Xi views the present actual property market as exacerbating inequality within the nation.

“For over three years he has been intoning the mantra that properties are for residing in, not for betting on. The Chinese language persons are lastly getting the message that Xi means enterprise halting home worth inflation,” she stated.

“Whereas preventing revenue and wealth inequality is a noble activity, the best way Xi has gone about it undermines two of an important dynamos of China’s improvement mannequin over the previous 40 years: personal enterprise and the authorities’ trial and error method to coverage change.”

Mok, the analysis fellow on the officially-backed Heart for China and Globalization, stated he believed Beijing wished for the personal sector to have a “delineated house given the altering wants of the inhabitants.”

“The rationale the CCP staked its legitimacy on financial progress in the course of the reform period was that the nation actually wanted financial progress on the time,” he stated. “(Then) China was characterised by financial deprivation, however on this century, Chinese language have principally what they need materially, when it comes to facilities, infrastructure, and many others. Which means individuals don’t care about financial progress to the identical diploma as they did earlier than.”

Mok stated Chinese language individuals should additionally realise their “increased intangible aspirations,” that are extra collectivist than individualistic. He described Xi Jinping Thought as China’s “new faith” that goals to fulfil the “psychological and religious wants of the individuals.”

Whatever the views of the plenty, Xi’s new paradigm doesn't augur nicely for the wants of personal companies.

“Xi’s frequent prosperity coverage and the ensuing regulatory crackdown had good intentions,” stated Wang. “Sadly, the results have confirmed to have stunted progress and critically dented confidence and progress of the personal sector.”

“The arrogance of the personal sector can't be decrease proper now, and that’s actually unhealthy for the financial system,” he added.

That shaky sentiment extends to traders exterior China, too. The worth of yuan-denominated foreign-held property in China noticed its greatest decline within the first quarter of 2022, plunging greater than $150bn. Capital has continued to circulate out since, with China’s debt markets dropping $7.7bn in August for a seventh consecutive month.

The Institute of Worldwide Finance (IIF) has predicted the entire outflow for 2022 to achieve $300bn.

Each the European and American Chambers of Commerce in China have reported dwindling enterprise confidence amongst their members this yr, with many pointing to lockdowns as exacerbating a broader financial slowdown. About half of the American members surveyed in April and Might had delayed or decreased investments, whereas greater than three-quarters of European members stated China had turn out to be much less enticing to spend money on.

Isaac Stone Fish, head of China-focused consultancy Technique Dangers, stated the outflow concerned a various group of traders.

“Partly it’s the various Chinese language traders primarily based in different nations who wish to transfer their cash out of China amid concern concerning the route the nation goes,” he stated.

“Whereas sure swimming pools of cash which might be extra politically influenced are decreasing publicity to China-related dangers as a way to preserve easy relations with their house governments.”

Stone Fish stated the preeminence of politics above all else had turn out to be the hallmark of the Chinese language financial system underneath Xi.

“The CCP at all times noticed themselves as legit just because they have been the rulers of China and since they believed solely communism might save China. Within the West, the communist ideology of the CCP is commonly downplayed and the celebration defined in financial phrases… the rationale China has claimed success is much less about financial progress and extra about fulfilling its imaginative and prescient of socialism,” Stone Fish stated.

“Within the West, the markets are in cost”, stated Mok, “however that's not so in China”.

“As for which financial system delivers one of the best ends in a political sense, nicely, we’ll have to attend and see.”

Post a Comment