Traders have soured over his public dedication to prioritise social spending over fiscal integrity and delays in naming his financial crew.

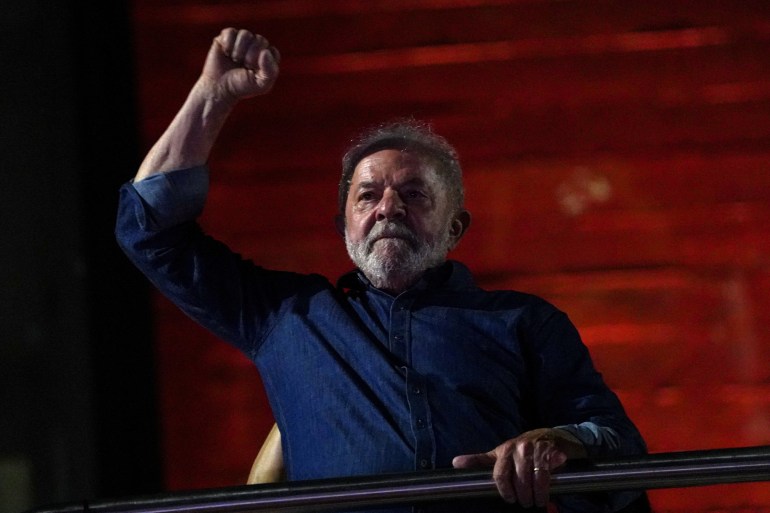

There may be rising investor pessimism that Brazilian President-elect Luiz Inacio Lula da Silva will govern with fiscal self-discipline because the nation’s central financial institution chief likened a market selloff to a “Liz Truss second for Brazil”.

Brazil’s actual foreign money and Bovespa inventory index each misplaced roughly 4 % on Thursday, as Lula’s transient honeymoon with buyers soured over his public dedication to prioritising social spending over fiscal integrity and delays in naming his financial crew.

The Brazilian actual clawed again losses on Friday, with the greenback closing the session down 1.24 after a risky day of buying and selling. Shares have been up greater than 2 %.

Regardless of these features, jitters remained, with buyers calling for Lula to revive agency guidelines for public spending after important outlays by outgoing President Jair Bolsonaro in the course of the pandemic and election marketing campaign.

Central financial institution chief Roberto Campos Neto, talking at an occasion in Sao Paulo, mentioned Thursday’s rout was the newest instance of markets demanding fiscal self-discipline amid a difficult world backdrop of excessive inflation, low development and little threat urge for food.

“I don’t know if that was a Liz Truss second for Brazil, nevertheless it was a transparent demonstration of the markets’ sensitivity to the fiscal problem,” Campos Neto mentioned, referring to the previous United Kingdom prime minister who resigned after the markets punished her push for unfunded tax cuts.

Citigroup Inc mentioned in a report that buyers could have been mistaken in considering Lula would pursue an orthodox fiscal agenda, including that the financial institution had determined to chop its threat publicity to Brazil within the face of this reassessment.

“The market appeared to have satisfied itself that Lula can be fiscally orthodox. The newest information now casts doubt on this speculation,” Dirk Willer, Citi Analysis’s head of rising markets technique, wrote on Thursday evening.

Milton Maluhy Filho, the chief government of Brazil’s largest lender Itau Unibanco ITUB4.SA, mentioned on Friday a steadiness wanted to be struck between social spending and placing public funds so as.

“We predict that fiscal duty and social duty ought to go hand in hand,” he mentioned in a convention name.

Traders and even Lula allies have additionally expressed concern about delays in naming his finance minister. Lula has mentioned he'll solely title his cupboard as soon as he returns from the COP27 local weather summit in Egypt.

Senator Simone Tebet, of the centrist Brazilian Democratic Motion celebration, mentioned the finance minister must be Lula’s first cupboard choose to clarify what his financial insurance policies are going to be.

“A finance minister is required to clarify the president’s political thought,” Tebet instructed reporters.

On Thursday, Lula sought to downplay buyers’ issues. “The market is nervous for nothing. I've by no means seen a market as delicate as ours,” mentioned the president-elect, who takes workplace on January 1.

Post a Comment