Moscow says it is not going to abide by the worth cap even when it has to chop oil manufacturing.

The value cap on Russian seaborne oil agreed upon by the European Union, the G7 and Australia has come into drive.

The cap of $60 per barrel, which took impact on Monday, is geared toward limiting Russia’s capacity to finance its struggle in Ukraine whereas ensuring it retains supplying the worldwide market.

Moscow, nevertheless, has stated it's going to not abide by the measure even when it has to chop manufacturing.

The cap comes on high of the EU’s embargo on imports of Russian crude by sea and comparable pledges by the USA, Canada, Japan and the UK.

It means Russian oil bought solely at a worth equal to or lower than $60 per barrel could be shipped to third-party nations utilizing G7 and EU tankers, insurance coverage corporations and credit score establishments. As a result of the world’s key delivery and insurance coverage corporations are based mostly in G7 nations, the cap might make it troublesome for Moscow to promote its oil for a better worth.

International locations that don't undertake the measure can proceed to purchase Russian oil above the worth cap, however with out utilizing Western providers to accumulate, insure or transport it.

“Now we have clear indicators that numerous rising economies, notably in Asia, will observe the rules of the cap,” a European official advised AFP information company, including that Russia is already “below strain” from its clients to supply reductions.

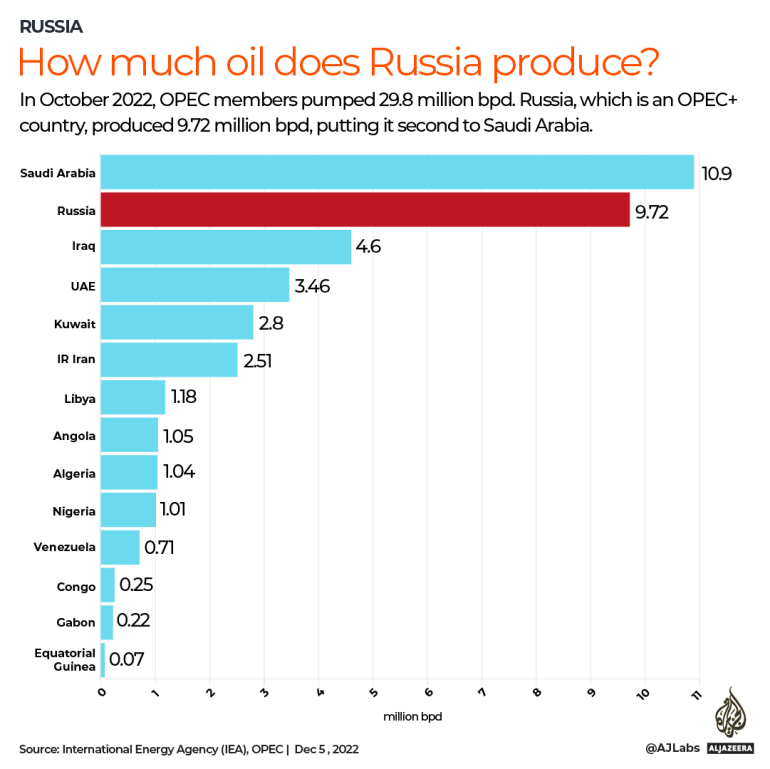

However Russia, the world’s second-largest oil exporter, stated on Sunday it will not settle for the cap and wouldn't promote oil that's topic to it.

Deputy Prime Minister Alexander Novak stated the transfer by the West was a gross interference that contradicted the foundations of free commerce and would destabilise international power markets by triggering a scarcity of provide.

“We're engaged on mechanisms to ban using a worth cap instrument, no matter what degree is about, as a result of such interference might additional destabilise the market,” he stated.

“We are going to promote oil and petroleum merchandise solely to these nations that may work with us below market situations, even when now we have to cut back manufacturing a bit,” he added.

Promoting oil and fuel to Europe has been one of many fundamental sources of Russian overseas foreign money earnings since Soviet geologists discovered oil and fuel within the swamps of Siberia within the a long time after World Battle II.

The G7 worth cap, which was agreed upon on Friday, isn't a lot under the $67 degree the place a barrel of Russian oil closed on the finish of the day. So, the EU and G7 nations count on Russia will nonetheless have an incentive to proceed promoting oil at that worth whereas accepting smaller earnings.

“Russia should retain an curiosity in promoting its oil” or threat decreasing international provide and inflicting costs to soar, a second European official advised AFP, saying they didn't imagine the Kremlin’s threats to cease deliveries to nations complying with the cap.

The official stated Russia would stay involved about sustaining the state of its infrastructure, which might be broken if manufacturing is halted, and preserving the boldness of its clients, together with China and India.

Whereas Russia could possibly be tempted to create its personal fleet of tankers, working and insuring them itself, Brussels believes “constructing a maritime ecosystem in a single day will likely be very sophisticated” – and such make-do measures might have bother convincing clients.

The extent of the cap is to be reviewed by the EU and the G7 each two months, with the primary such overview scheduled for mid-January.

“This overview ought to take note of … the effectiveness of the measure, its implementation, worldwide adherence and alignment, the potential affect on coalition members and companions, and market developments,” the European Fee stated in an announcement.

The cap on crude will likely be adopted by the same measure affecting Russian petroleum merchandise that may come into drive on February 5, though the extent of that cap has nonetheless to be determined.

Post a Comment