The present mortgage of $2bn shall be topped with a further mortgage of $1bn, a press release by the Pakistani prime minister’s workplace says.

The United Arab Emirates is pledging a $1bn mortgage to cash-strapped Pakistan and in addition agreed to roll over an current mortgage of $2bn in a lift to the South Asian nation grappling with an financial disaster, in accordance with Pakistan prime minister’s workplace.

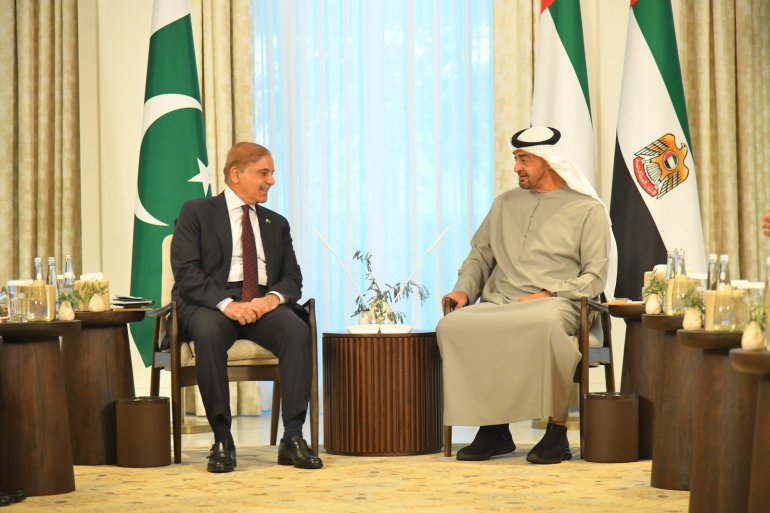

The announcement got here after Pakistani Prime Minister Shehbaz Sharif held talks with UAE President Sheikh Mohamed bin Zayed Al Nahyan within the capital Abu Dhabi on Thursday on his third go to to the Gulf nation after taking workplace final April.

The 2 leaders “agreed to deepen the funding cooperation, stimulate partnerships and allow funding integration alternatives between the 2 nations,” a PMO assertion stated.

Sharif has been struggling to place the economic system on monitor since taking workplace, along with his first finance minister Miftah Ismail resigning abruptly final September.

Islamabad is looking for monetary assist from its shut allies similar to Saudi Arabia and China, in addition to the UAE because it negotiates for the following tranche of loans from the Worldwide Financial Fund (IMF).

Ismail advised Al Jazeera that the choice to roll over the fund is “nice information to Pakistan”, and the announcement was seen by some analysts as a much-needed aid to the nation which has seen its central financial institution’s international reserves deplete to lower than $4.5bn, overlaying lower than a month of imports.

‘Precarious economic system’

Ammar Habib Khan, an Islamabad-based economist, stated that the extra funding would offer well timed assist to Pakistan’s precarious economic system.

On Wednesday, the World Financial institution slashed the gross home product (GDP) development projections to 2 p.c. The dire financial scenario has pressured the federal government to resort to excessive steps, similar to closing malls and eating places early.

“This funding will present some assist to Pakistan to handle its imports. Nevertheless, to get out of the disaster, it does want extra injection of dollars, necessitating continuation of the Worldwide Financial Fund programme,” he advised Al Jazeera.

Pakistan has struggled to persuade the IMF to launch the following tranche of $1.1bn loans, which has been pending since September on account of impasse between the 2 events.

The funding was dependent upon the nation agreeing to the lender’s numerous situations, similar to rising vitality costs and increasing the tax base. Pakistan entered an IMF programme in 2019 and the final tranche of the fund price $1.17bn was delivered in August final yr.

Some specialists warned towards donor fatigue of Pakistan’s reliance on bilateral funds.

“It's like giving cash to a drug addict who guarantees to fix his methods however comes again asking for more cash,” Asad Sayeed, an economist based mostly within the port metropolis of Karachi, advised Al Jazeera.

Saudi Arabia deposited $3bn in Pakistan Central Financial institution in October and there are experiences that Saudi Crown Prince Mohammed bin Salman has requested Saudi Fund for Growth to look into rising the deposit by one other $2bn.

China stays Pakistan’s greatest lender at $30bn – one-third of its international debt.

‘No possibility however to simply accept the IMF programme’

Sayeed, who works for the analysis agency Collective for Social Science Analysis, stated that Pakistan doesn't have many decisions left and has no choices however to simply accept the IMF programme.

Pakistan should make greater than $20bn funds in debt obligation within the subsequent 12 months, in accordance with the central financial institution’s information. A take care of IMF could assist unlock extra bilateral help.

Not coming into the worldwide lender’s programme, Sayeed stated, goes to create a scenario with “unimaginable penalties”.

One of many dangers was default, which might crash the economic system.

“The authorities should ask themselves in the event that they’d desire to have a large surge of inflation hit the inhabitants, or they need to discover themselves a scenario the place the nation doesn't have any gasoline or pulses or all of the issues that we import. Ours is an import-dependent economic system and working out of dollars would result in an unprecedented scenario for us,” he warned.

Pakistan’s authorities has been reluctant to simply accept the IMF programme due to the cruel situations, which included slashing of subsidies, which may additional push inflation up.

Authorities information indicated that Pakistan’s import invoice for the final six months of the yr 2022 was greater than $30bn, of which, greater than $5bn was for petroleum merchandise.

Pakistan has already been battling the aftermath of devastating floods final yr that killed 1,700 folks and led to the lack of billions of dollars.

The nation was capable of safe greater than $10bn in a world donors’ convention in Geneva final week to rebuild the nation ravaged by the floods, most of which was within the type of loans.

Sharif invited the UAE president to go to Pakistan on a state go to which was accepted.

The Pakistani prime minister was scheduled to fulfill UAE Prime Minister and the ruler of Dubai Sheikh Mohammed bin Rashid Al Maktoum.

He was additionally anticipated to carry conferences with Emirati businessmen and traders to debate methods to boost bilateral commerce between Pakistan and the UAE.

Pakistan’s new military chief, Normal Syed Asim Munir, additionally met UAE President Al Nayhan two days in the past as a part of his one-week journey that additionally included shut ally Saudi Arabia.

Post a Comment