The buyer worth index jumped 7.9 p.c from a 12 months earlier following a 7.5 p.c annual achieve in January.

U.S. client worth good points accelerated in February to a recent 40-year excessive on rising gasoline, meals and housing prices, with inflation poised to rise even additional following Russia’s invasion of Ukraine.

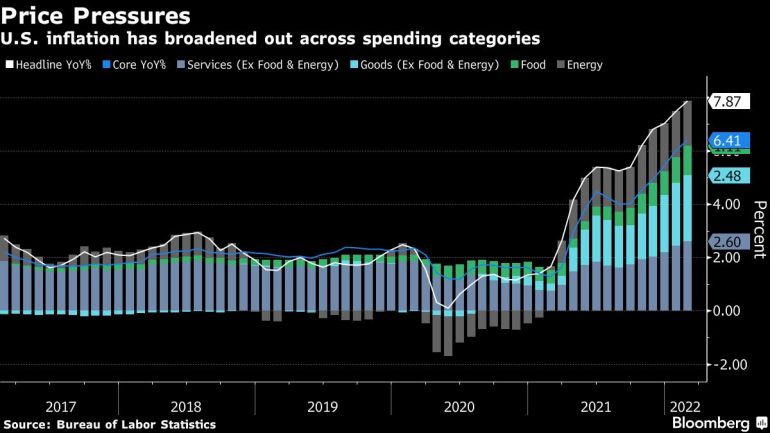

The buyer worth index jumped 7.9% from a 12 months earlier following a 7.5% annual achieve in January, Labor Division information confirmed Thursday. The broadly adopted inflation gauge rose 0.8% in February from a month earlier, reflecting larger gasoline, meals and shelter prices. Each readings matched the median projections of economists in a Bloomberg survey.

Excluding unstable meals and power elements, so-called core costs elevated 0.5% from a month earlier and 6.4% from a 12 months in the past.

The info illustrate the extent to which inflation was tightening its grip on the economic system earlier than Russia’s conflict led to a spike in commodities, together with the best retail gasoline worth on file. Most economists had anticipated February could be the height for annual inflation, however the battle doubtless means even larger inflation prints within the coming months.

“Inflation is just not prone to roll over and start to return down for a number of extra months,” Michael Gapen, chief U.S. economist at Barclays Plc stated on Bloomberg Tv. “This units the stage for the place we at the moment are. And we have to see how lengthy this battle performs out and the way disruptive the sanctions regime truly is.”

To fight constructing worth pressures, the Federal Reserve is ready to boost rates of interest subsequent week for the primary time since 2018. On the similar time, the geopolitical state of affairs provides uncertainty to the central financial institution’s charge mountaineering cycle over the approaching 12 months.

Fed officers might take a extra hawkish stance if power worth shocks result in larger and extra persistent inflation, however additionally they might take a extra cautious method if sinking client sentiment and declining actual wages start to weigh on progress because the conflict drags on.

The February report confirmed that gasoline costs rose 6.6% from the prior month and accounted for nearly a 3rd of the month-to-month enhance within the CPI. A few of which will mirror power worth spikes ensuing from the primary days of Russia’s invasion over the last week of the month. The impression will likely be extra absolutely captured within the March CPI report.

Up to now this month, the retail worth of a regular-grade gasoline has elevated 19.3% to $4.32 a gallon, in accordance with American Car Affiliation information.

Meals costs climbed 1% from the prior month, the most important advance since April 2020, the CPI report confirmed. In contrast with February final 12 months, the 7.9% leap was the most important since 1981.

Whereas the conflict’s full impression on the U.S. economic system stays unclear, hovering prices of oil, grains and metals are prone to feed by way of to different commodities and in the end client costs. The Biden administration on Tuesday banned Russian oil imports into the U.S., a transfer that can add to power worth pressures.

Actual Earnings

Wage will increase because of a decent labor market haven’t been maintaining with inflation. Inflation-adjusted common hourly earnings dropped 2.6% in February from a 12 months earlier, the most important drop since Could and the eleventh straight lower, separate information confirmed Thursday.

The report confirmed that costs for merchandise continued their climb in February, whereas annual progress in providers prices accelerated. On a year-over-year foundation, items inflation rose by 13%, probably the most since 1980. That included the largest-ever annual enhance in costs of recent vehicles and vans.

Companies prices elevated 4.8% from a 12 months in the past, the most important advance since 1991.

Shelter prices — that are thought of to be a extra structural part of the CPI and make up a few third of the general index — rose 0.5% from the prior month, probably the most since November. Lease of main residence elevated 0.6% on a month-to-month foundation, the most important advance since 1987.

Motor-vehicle restore prices shot up by a file 4.3% from January, and an index of private care jumped an unprecedented 1.2%.

The costs of resort stays and airfares rebounded in February following the omicron-related pullback in financial exercise in December and January.

(Provides economist’s remark)

–With help from Julia Fanzeres, Kristy Scheuble and Reade Pickert.

Post a Comment