The S&P 500 superior after flirting with bear-market territory – outlined by a 20 p.c plunge from a latest file.

Shares bounced again on the finish of a chaotic week in monetary markets, with a bit of assist from Federal Reserve Chair Jerome Powell’s reassurance that greater charge hikes can be off the desk for now even after the recent inflation readings of the previous few days.

The S&P 500 superior after flirting with bear-market territory — outlined by a 20% plunge from a latest file. Nevertheless it nonetheless headed towards its sixth straight week of declines — the longest dropping streak since June 2011. Tech shares outperformed amid beneficial properties in giants like Apple Inc., Microsoft Corp. and Amazon.com Inc. In the meantime, Elon Musk prompted chaos over his takeover supply for Twitter Inc, first claiming his bid was “quickly on maintain” after which sustaining he's “nonetheless dedicated” to the deal — sending the social media large right into a tailspin. Tesla Inc. pushed greater. Treasuries fell.

Powell reaffirmed that the central financial institution is prone to increase rates of interest by a half proportion level at every of its subsequent two conferences, whereas leaving open the chance it may do extra. In a interview with the Market public radio program on Thursday, he made clear his dedication to struggle inflation, however conceded that the Fed’s potential to try this with out triggering a recession could rely upon elements outdoors its management.

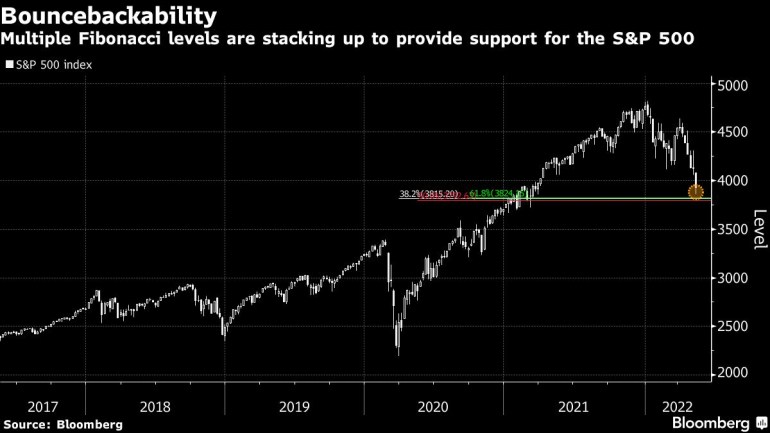

Expectations of a technical bounce within the S&P 500 are constructing after a drop of about 18% from a file excessive in January. One potential zone of help comes from a cluster of Fibonacci ranges, which seize retracements of rallies within the U.S. fairness benchmark from 2020 Covid crash lows. The cluster lies within the 3,790 to three,825 space, and a sustained break beneath would carry 3,500 to three,550 into focus.

A number of the major strikes in markets:

Shares

- The S&P 500 rose 1.2% as of 9:31 a.m. New York time

- The Nasdaq 100 rose 1.8%

- The Dow Jones Industrial Common rose 0.8%

- The Stoxx Europe 600 rose 1.5%

- The MSCI World index rose 1.2percentCurrencies

- The Bloomberg Greenback Spot Index was little modified

- The euro fell 0.2% to $1.0360

- The British pound fell 0.3% to $1.2169

- The Japanese yen fell 0.7% to 129.20 per greenback

Bonds

- The yield on 10-year Treasuries superior six foundation factors to 2.90%

- Germany’s 10-year yield superior eight foundation factors to 0.92%

- Britain’s 10-year yield superior six foundation factors to 1.72%

Commodities

- West Texas Intermediate crude rose 2.8% to $109.10 a barrel

- Gold futures fell 1.3% to $1,801.20 an oz.

–With help from Sunil Jagtiani, John Viljoen, Srinivasan Sivabalan, Vildana Hajric, Isabelle Lee and Akshay Chinchalkar.

Post a Comment