The info mirror the largest month-to-month achieve within the value of products in information again to 2009, with two-thirds of the rise attributable to vitality.

Costs paid to U.S. producers rose strongly in February on larger prices of products, underscoring inflationary pressures that set the stage for a Federal Reserve fee hike this week.

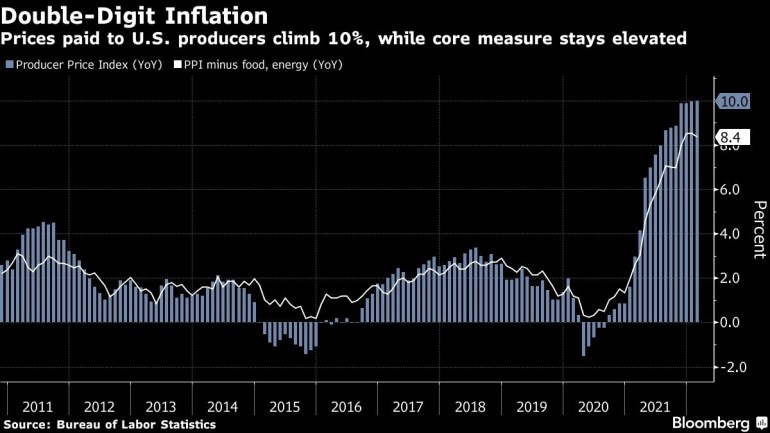

The producer value index for remaining demand elevated 10% from February of final 12 months and 0.8% from the prior month, Labor Division information confirmed Tuesday. That adopted an upwardly revised 1.2% month-to-month achieve in January.

The median forecasts in a Bloomberg survey of economists referred to as for a ten% year-over-year improve and a 0.9% month-to-month advance.

Two-year Treasury yields prolonged declines and U.S. inventory futures rose after the information confirmed producer costs rose lower than anticipated on a month-to-month foundation.

The info mirror the largest month-to-month achieve within the value of products in information again to 2009, with two-thirds of the rise attributable to vitality. Meals costs have been additionally up. It’s the newest indication of fast inflation within the U.S., and costs are poised to speed up additional after Russia’s invasion of Ukraine despatched costs of some uncooked supplies to new highs.

Whereas that bolsters the case for the Fed to be aggressive in tamping down inflation within the coming months, the central financial institution should stability curbing inflation with out stifling financial development.

The Fed can have the newest inflation information in hand for its assembly that concludes Wednesday, when coverage makers are extensively anticipated to extend rates of interest for the primary time since 2018. Together with the choice, the Fed will launch up to date forecasts for inflation and development.

The info recommend persistent inflationary pressures in manufacturing will filter via to shopper costs, which rose in February on the quickest tempo in 40 years, partly attributable to larger gasoline, meals and housing prices. That’ll solely worsen given the battle, and China’s lockdown of Shenzhen — one of many nation’s most populous cities and a know-how hub — is predicted to disrupt fragile provide chains much more.

Excluding the risky meals and vitality parts, the so-called core PPI elevated 0.2% from a month earlier and was up by a 8.4% from a 12 months in the past, each lacking estimates.

There have been indicators in different components of the economic system that inflationary pressures have been cooling. Costs for remaining demand providers have been little modified from January, the primary month with out a rise since December 2020.

A rise in transportation and warehousing providers prices was offset by declines in portfolio administration and attire and equipment retailing. The report captures modifications in costs paid to producers in addition to margins acquired by wholesalers and retailers.

A separate report Tuesday confirmed costs acquired by New York state producers superior to the best in information again to 2001, whereas a measure of enter prices stayed elevated.

Producer costs excluding meals, vitality, and commerce providers — a measure typically most popular by economists as a result of it strips out essentially the most risky parts — rose 0.2% from January. In contrast with a 12 months earlier, the gauge decelerated.

Prices of processed items for intermediate demand, which mirror costs earlier within the manufacturing pipeline, elevated 1.6% from a month earlier, over 40% of which will be attributed to an increase within the value of diesel gas. In contrast with a 12 months earlier, the measure was up 23.3%.

(Provides economist’s remark)

–With help from Olivia Rockeman, Chris Middleton and Alex Tanzi.

Post a Comment