The S&P 500 slid 2.8 p.c, the largest decline since March 7.

U.S. shares fell, capping a 3rd weekly decline, as disappointing company outcomes and prospects for aggressive interest-rate hikes weighed on sentiment.

The S&P 500 slid 2.8%, the largest decline since March 7, tipping the benchmark to a weekly decline within the longest run of losses for the interval since January. Declines in tech-heavy Nasdaq 100 left it down greater than 9% up to now in April, poised for the worst month since 2008. In the meantime, the market’s so-called concern gauge — the Cboe Volatility Index or VIX — jumped to a one-month excessive. The greenback rose to the very best degree since June 2020.

Amongst company earnings, Verizon Communications Inc. had its greatest drop in two years after slicing its full-year gross sales forecast. American Categorical Co. fell after the credit-card large reported that bills jumped within the first quarter.

Merchants have elevated bets on the Federal Reserve tightening coverage after Chair Jerome Powell this week outlined his most aggressive strategy but to taming inflation, probably endorsing two or extra half percentage-point fee will increase. Shares briefly bounced off session lows late Friday after Cleveland Fed President Loretta Mester pushed again in opposition to elevating rates of interest by 75 foundation factors at a single assembly, favoring a “methodical strategy.”

“A extra aggressive financial coverage is getting priced throughout the board on the quick finish of the curve whereas additionally contaminating the remainder of it,” mentioned Florian Ielpo, head of macro at Lombard Odier Asset Administration. “The fairness market had difficulties factoring on this surge in yields, over an earnings-season interval that seems to be shaky.”

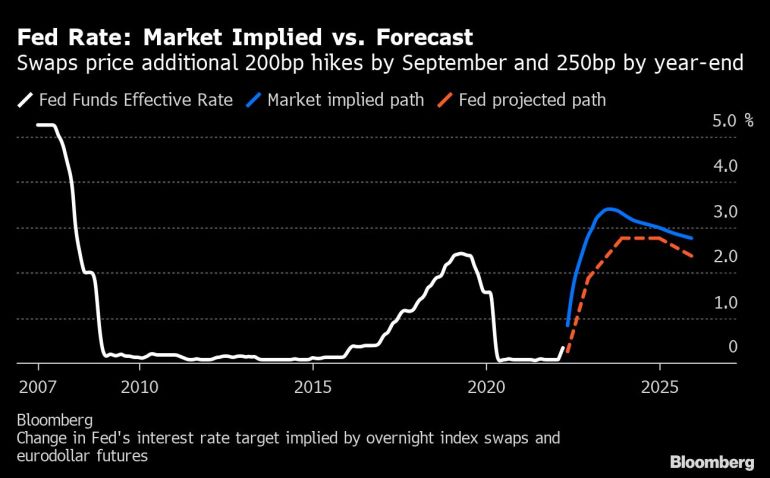

Cash markets priced in 200 foundation factors of tightening by the Fed’s September determination, in line with interest-rate swaps. That suggests a half-point hike — remarkable since 2000 — in Could, June, July and September.

Powell on Thursday cited minutes from final month’s coverage assembly that mentioned many officers had famous “a number of” 50 basis-point hikes could possibly be acceptable to curb the most well liked inflation in 4 a long time.

Well being-care shares tumbled, with HCA Healthcare Inc. sinking after slicing its forecast on labor prices. Intuitive Surgical Inc. tumbled after its programs placements dissatisfied some analysts at the same time as income beat estimates.

On the flip facet, Kimberly-Clark Corp. surged after first-quarter gross sales and revenue beat Wall Road’s estimates, as the corporate handed on increased prices to shoppers. To this point within the earnings season, with 98 S&P 500 corporations which have reported quarterly outcomes, greater than 79% have crushed estimates for revenue and 65% have surpassed gross sales forecasts.

European equities joined Friday’s selloff as monetary ends in the continent proved to be a combined bag and stronger tightening indicators from the European Central Financial institution undermined threat urge for food. Traders additionally braced for the second spherical of voting within the French presidential election this Sunday, the place Emmanuel Macron will face off in opposition to Marine Le Pen. The euro fell for a second day in opposition to the greenback.

Among the important strikes in markets:

Shares

- The S&P 500 fell 2.8% as of 4 p.m. New York time

- The Nasdaq 100 fell 2.6%

- The Dow Jones Industrial Common fell 2.8%

- The MSCI World index fell 2.5%

Currencies

- The Bloomberg Greenback Spot Index rose 0.7%

- The euro fell 0.3% to $1.0797

- The British pound fell 1.5% to $1.2833

- The Japanese yen fell 0.1% to 128.53 per greenback

Bonds

- The yield on 10-year Treasuries declined one foundation level to 2.89%

- Germany’s 10-year yield superior two foundation factors to 0.97%

- Britain’s 10-year yield declined 5 foundation factors to 1.96%

Commodities

- West Texas Intermediate crude fell 2% to $101.73 a barrel

- Gold futures fell 0.7% to $1,934.70 an oz.

–With help from Akshay Chinchalkar, Sunil Jagtiani, Srinivasan Sivabalan, Isabelle Lee and Peyton Forte.

Post a Comment