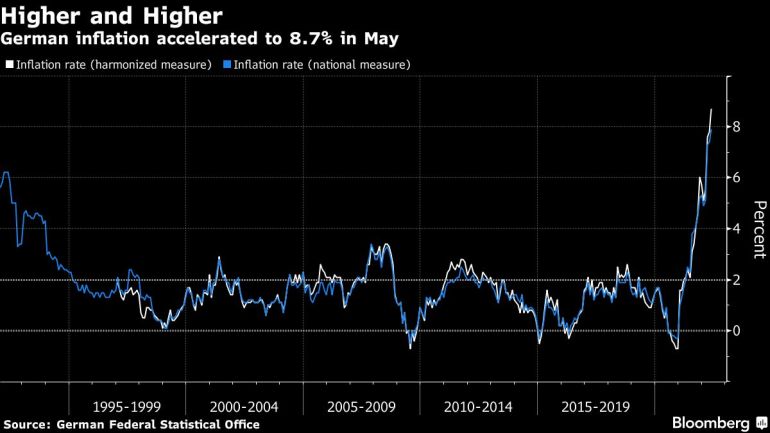

Shopper costs within the continent’s greatest financial system jumped 8.7 p.c from a 12 months in the past in Might.

German inflation hit one other all-time excessive, including urgency to the European Central Financial institution’s exit from crisis-era stimulus after numbers from Spain additionally topped economists’ estimates.

Pushed by hovering vitality and meals prices, information launched Monday confirmed client costs within the continent’s greatest financial system jumped 8.7% from a 12 months in the past in Might. Analysts surveyed by Bloomberg predicted an 8.1% advance.

The report comes simply 10 days earlier than an important ECB assembly the place officers are set to announce the conclusion of large-scale asset purchases and ensure plans to boost rates of interest in July for the primary time in additional than a decade. Some coverage makers have even floated the concept of a half-point hike, reasonably than the quarter-point most of them help.

Cash markets wagered on 113 foundation factors of price will increase by year-end, up three foundation factors since Friday. German bonds held declines, with benchmark 10-year yields eight foundation factors greater at 1.05%.

The inflation figures improve stress on the federal government as households are additional squeezed. Finance Minister Christian Lindner earlier Monday referred to as the struggle towards surging costs the “prime precedence” whereas advocating an finish to expansive fiscal coverage.

“Inflation is a gigantic financial danger,” Lindner informed a information convention in Berlin. “We should struggle it in order that no financial disaster outcomes and a spiral takes maintain wherein inflation feeds off itself.”

ECB coverage makers together with President Christine Lagarde have expressed related considerations, fretting that stubbornly excessive value development dangers changing into entrenched and damping consumption at a time when trade is affected by lingering provide bottlenecks and uncertainty about vitality provides following Russia’s invasion of Ukraine.

Family Damage

Whereas inflation is now close to its peak, the squeeze for households is way from over, based on ZEW Economist Friedrich Heinemann.

“Customers must reckon with additional will increase in costs as a result of many inputs are nonetheless scarce and wholesale costs are nonetheless rising dramatically,” he stated by e mail. “Surprisingly good labor-market information additionally point out that the dreaded wage-price spiral may quickly choose up velocity.”

The ECB’s choices in June shall be guided by recent financial projections which might be prone to present value pressures within the euro space as an entire remaining above the two% goal in 2023 and 2024. Knowledge for Might from the 19-member forex bloc are due on Tuesday.

Highlighting the persistent risks, Spain earlier Monday reported an sudden acceleration in inflation to a report 8.5%, regardless of authorities help together with a gas subsidy and a rise within the minimal wage. A Belgian measure additionally quickened.

In Germany, the decrease home of parliament has handed a package deal of reduction measures that features a one-time fee, a toddler complement and a discount in electrical energy prices. Chancellor Olaf Scholz has signaled additional motion could also be taken if wanted to guard households and companies.

Negotiated wages in Germany fell by 1.8% in actual phrases within the first quarter, and though staff within the iron and metal trade are pushing for positive factors of greater than 8%, they’re unlikely to safe positive factors that absolutely offsetting the rising price of dwelling.

(Updates with Bloomberg Economics in eleventh paragraph.)

–With help from Kristian Siedenburg, Harumi Ichikura, Birgit Jennen, Zoe Schneeweiss, Alexander Weber and James Hirai.

Post a Comment