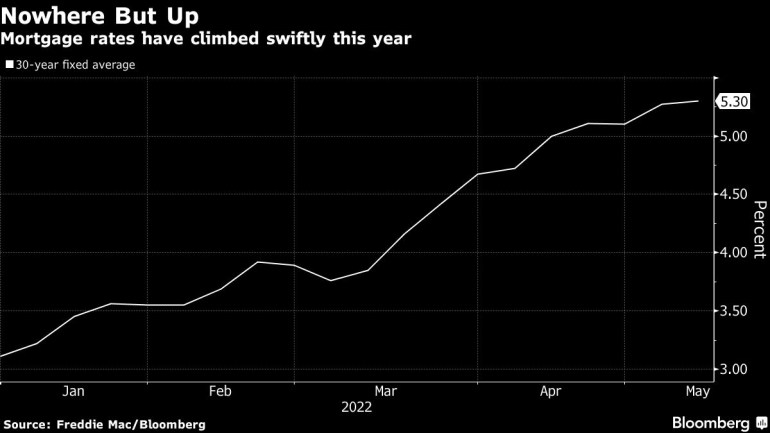

The common price for a 30-year mortgage was 5.3 %, up from 5.27 % final week and the best since July 2009, in accordance with United States knowledge.

US mortgage charges jumped once more this week, extending a steep climb that's shutting some would-be homebuyers out of the market.

The common for a 30-year mortgage was 5.3%, up from 5.27% final week and the best since July 2009, Freddie Mac mentioned in an announcement Thursday.

Charges tracked yields for 10-year Treasuries, which final week reached 3% for the primary time since 2018. US shopper costs rose greater than forecast in April, signaling the Federal Reserve will have to be aggressive in its efforts to include inflation. Because the Fed raises benchmark rates of interest, mortgage prices are anticipated to comply with.

In what’s historically the housing market’s busiest and best season, greater charges will put extra strain on patrons to seal offers earlier than loans get much more costly. Others are delaying residence searches after calculating that they can’t afford greater mortgage payments.

On the present 30-year common, a borrower with a $300,000 mortgage would pay $1,666 a month, $384 greater than on the finish of final 12 months.

The various money patrons available in the market, together with downsizers and property traders, aren’t price delicate, in order that they’ll proceed to make purchases at the same time as first-time patrons pull again, mentioned Greg McBride, chief monetary analyst at Bankrate.com.

“The run up of mortgage charges since starting of the 12 months has the identical influence on affordability as a rise in residence costs of greater than 20%,” McBride mentioned. “It'll actually mood demand as many would-be homebuyers are priced out. However rising charges gained’t flip this right into a purchaser’s market so long as stock stays as little as it's.”

Adjustable-rate mortgages are gaining popularity as a less expensive choice. Final week, ARMs — with variable rates of interest that reset primarily based available on the market at predetermined instances — accounted for the largest share of home-loan functions since 2008, knowledge from the Mortgage Bankers Affiliation present.

The present common for five-year ARMs is 3.98%, Freddie Mac mentioned, up from 3.96% final week.

(Updates with feedback from analyst beginning in sixth paragraph.)

Post a Comment