Apple, Google, and Samsung are among the many tech giants increasing operations within the fast-growing Southeast Asian nation.

Ho Chi Minh Metropolis, Vietnam – In industrial parks set among the many rolling hills and tea fields of northern Vietnam, legions of manufacturing unit staff are busy making merchandise for main tech giants akin to Apple, Samsung, LG Electronics and Microsoft.

Already lots of of 1000's robust, their ranks are swelling quick.

Pissed off with China’s “zero-COVID” lockdowns halting manufacturing at a second’s discover, producers are looking for alternate options to the world’s greatest financial system and No 1 manufacturing hub. Vietnam, with its low cost labour, geographic proximity to China and secure political surroundings, is a key beneficiary.

“For lots of those corporations, they withstood the commerce warfare, they withstood rising labour prices in China, after which they withstood the breakdown of provide chains throughout COVID… [China’s] zero-COVID coverage I believe now could be the straw that breaks the camel’s again,” Greg Poling, director of the Southeast Asia Program on the Middle for Strategic and Worldwide Research (CSIS), instructed Al Jazeera.

“Vietnam just isn't the one place that multinationals need to diversify out of China, however Vietnam might be probably the most profitable.”

Apple, Google and Samsung are all pushing forward with firsts within the Southeast Asian nation.

Foxconn and Luxshare Precision Trade, two of Apple’s most essential suppliers, are presently in talks to make Apple Watches and Macbooks in Vietnam for the primary time. To assist its Vietnam enlargement, Taiwan-based Foxconn has introduced plans to speculate $300m in a brand new 50.5-hectare manufacturing unit in Bac Giang, a northern province positioned about 50km (31 miles) from Hanoi.

Manufacturing of different Apple merchandise in Vietnam can be anticipated to extend – 65 % of AirPods, the agency’s signature wi-fi earphones, will probably be made there by 2025, based on an evaluation by JP Morgan final month.

Google is about to start manufacturing its Pixel smartphones in Vietnam from 2023, whereas Samsung plans to start out making semiconductor parts subsequent summer season at a sprawling manufacturing unit in Thai Nguyen province.

“It’s simply too costly to be in China now,” Albert Tan, an affiliate professor on the Asian Institute of Administration in Manila, Philippines, instructed Al Jazeera. “The issue is that the lockdowns are so unpredictable and so frequent… Many factories are transferring to Vietnam.”

Tan stated that, with the precise insurance policies, Vietnam may develop into the “subsequent powerhouse” in Asia for manufacturing.

“However it's a query of how briskly Vietnam can choose up all these sorts of producing from China and construct up their very own capabilities,” he stated.

Vietnam was one of many poorest international locations on the planet earlier than rising as a tech manufacturing hub following the implementation of liberal financial reforms often called Doi Moi within the late Eighties.

After strict COVID lockdowns inflicted the worst financial contraction in a long time final yr, Vietnam formally shifted away from “zero-COVID” to residing with the virus following the mass rollout of vaccines. The World Financial institution has projected the Southeast Asian financial system to develop 7.2 % this yr – up from 2.6 % progress final yr – in contrast with 2.8 % progress for China.

A lot of that progress will be attributed to exports, which within the first six months of 2022 reached $186bn – a greater than a 17 % improve yr on yr.

Whereas China’s COVID insurance policies have sapped investor confidence, analysts hint Vietnam’s rising standing to lengthy earlier than the pandemic.

“Vietnam has been getting a excessive quantity of overseas direct funding since commerce tensions with China flared and China’s manufacturing unit labour prices began rising quickly almost 10 years in the past,” David Dapice, economist with the Vietnam Program at Harvard’s Kennedy College, instructed Al Jazeera.

Insurance policies encouraging funding and commerce

Vietnam has made strides in opening up commerce and inspiring funding lately, becoming a member of 15 free commerce agreements, together with six pacts with regional companions as a part of the Affiliation of Southeast Asian Nations.

“Vietnam signed plenty of FTAs with many international locations so the customs are good,” Eddie Han, a senior analyst with Isaiah Analysis in Taiwan, instructed Al Jazeera. “Getting parts from mainland China to Vietnam may be very simple. They'll simply use vehicles and go on land.”

Poling, the CSIS analyst, stated Vietnam has been capable of distinguish itself from opponents like Indonesia and the Philippines by business-friendly coverage selections and political stability.

“What Vietnam has performed that places it above these two opponents is it has elevated the convenience of doing enterprise very purposefully,” he stated. “When you’re a overseas investor and also you signal a 30-year contract with Vietnam, you will be pretty positive that that contract will nonetheless be honoured 30 years from now. You'll be able to’t actually say that in Indonesia or the Philippines.”

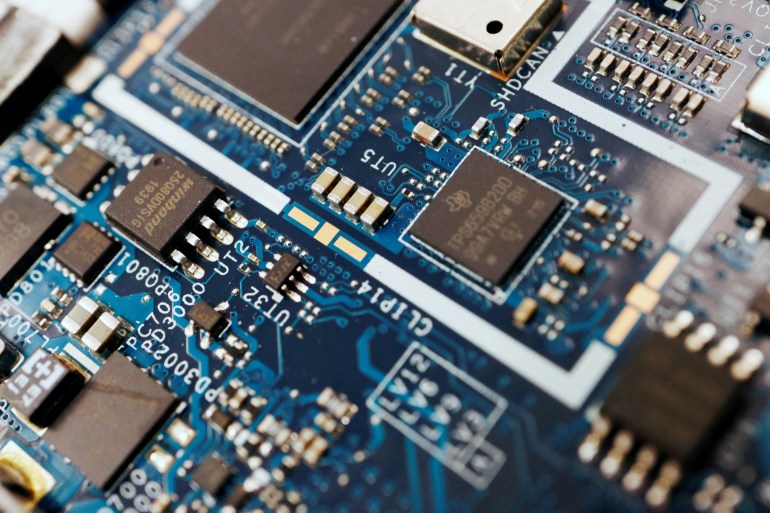

Past tech devices like iPhones, Vietnam can be changing into more and more essential within the semiconductor provide chain, which includes extra complicated manufacturing than different items.

Intel final yr invested $475m in its largest chip meeting and testing website in Ho Chi Minh Metropolis. In August, Roh Tae-Moon, CEO of the Samsung Electronics cellular division, introduced that the South Korean firm would make investments $3.3bn into producing semiconductor parts at its Thai Nguyen manufacturing unit by July 2023. Synopsys, a US chip design software program firm, introduced the identical month it might shift funding and engineer coaching to Vietnam.

“What’s fascinating for me is that this improve in value-added and the expertise side of what Vietnam exports,” Craig Martin, chairman of Ho Chi Minh Metropolis-based asset administration agency Dynam Capital, instructed Al Jazeera.

“The extra complicated and stickier that income is in your meeting course of, the stickier that overseas direct funding is,” Martin stated of Samsung’s transfer to fabricate semiconductor parts in Vietnam. “This evolution in transferring up the worth chain of exports is nice information.”

Nonetheless, some observers are uncertain of how far Vietnam can go as a high-tech manufacturing hub. Vietnam’s workforce is only a fraction of the dimensions of China’s and fewer expert than in Asian friends akin to South Korea and Japan. Corruption, regardless of crackdowns by authorities and bettering perceptions, stays widespread and extreme.

“I don’t discover the labour in Vietnam has an excellent talent degree in doing manufacturing. They want extra coaching,” Le Cong Dinh, a lawyer and enterprise adviser in Ho Chi Minh Metropolis, instructed Al Jazeera.

“Corruption could also be one other downside in doing enterprise right here. Many of the worldwide corporations like Apple, they by no means wish to pay below the desk to fulfil or facilitate their manufacturing,” he added. “Southeast Asian international locations or India have the identical downside however the degree possibly just isn't [the same as] Vietnam.”

Dapice stated that one among Vietnam’s major attracts – low cost labour – can solely final so lengthy. Because the financial system grows, wages are inevitably going to rise, too.

“I count on these longer-term developments will proceed till Vietnam runs out of staff,” Dapice stated of the manufacturing growth. “[This] could possibly be in a number of years when these in agriculture not wish to transfer, even when their incomes are decrease.”

Post a Comment