Apple rose for an Eleventh-consecutive day in New York to shut at $178.96, roughly $3 shy of its report reached in January.

Apple Inc. prolonged features on Tuesday, in a winning-streak final seen practically twenty years in the past, as improved threat sentiment is sending traders again to the most important U.S. expertise firms.

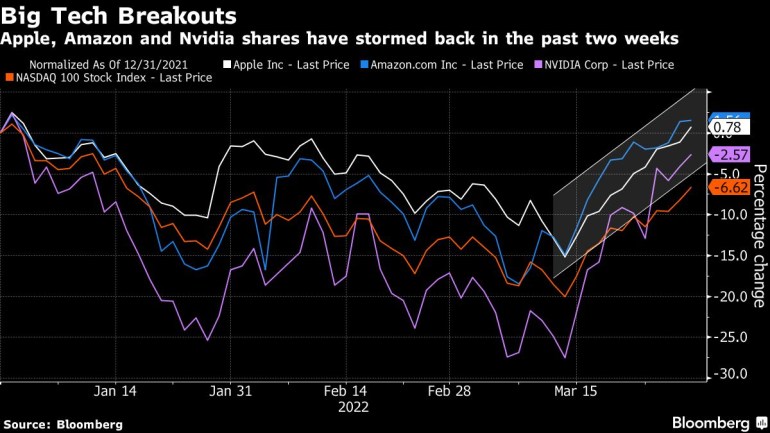

Apple rose for an Eleventh-consecutive day in New York, climbing 1.9% to shut at $178.96 and roughly $3 shy of a closing report reached in early January. The longest-winning streak since 2003 despatched the inventory again into the inexperienced for the yr, and follows related breakouts in Nvidia Corp. and Amazon.com Inc. up to now week.

“What we’re seeing is the distinction between firms which might be truly performing phenomenally effectively and people whose future is tougher to quantify,” stated Ross Gerber, chief government officer of Gerber Kawasaki Inc. “Persons are betting on the businesses which might be rising earnings the quickest over time.”

With prospects for some scaling again within the conflict in Ukraine boosting threat sentiment, consideration turned to Apple’s income outlook. Analysts have elevated their earnings per share estimates by 8.6% to date this yr, whereas these for the S&P 500 have gained 4.6%, based on knowledge compiled by Bloomberg.

Buyers additionally largely bypassed a Nikkei report about manufacturing cuts, leaving the inventory inside placing distance of a $3 trillion market worth.

The current rally comes after a tough begin of the yr for giant tech, whose marquee names had fallen behind the broader market because the Federal Reserve signaled it could elevate rates of interest a number of occasions. Larger rates of interest harm the current worth of future income, hurting development shares with lofty valuations, together with expertise.

However traders who initially fled the sector have began to return again, enticed by reductions and the assumption giant expertise firms with sturdy steadiness sheets and broad publicity to fast-growing markets like cloud computing can proceed to churn out larger income.

“The selloff bought overdone, and took these large tech names all the way down to ranges that had been very enticing,” stated David Katz, chief funding officer at Matrix Asset Advisors. “Apple is a really sturdy and dynamic development firm, and it stays on the higher finish of the pack when it comes to its valuation.”

‘Confounding’ Rally

Among the many different Nasdaq 100 bellwethers, Amazon rose 0.2% on Tuesday, whereas Alphabet Inc. superior 0.7% and Microsoft Corp. gained 1.5%. Regardless of this week’s rebound, the Nasdaq 100 stays down about 7% for the yr.

The rally in large tech amid rising rates of interest has left some traders scratching their heads. The yield on 10-year U.S. Treasuries has superior greater than 50 foundation factors this month to 2.39%.

Lisa Shalett, chief funding officer of Wealth Administration at Morgan Stanley, wrote that the advance within the teach-heavy Nasdaq 100 has been “confounding,” because it comes at a time of upper rates of interest because the Fed takes steps to combat inflation.

To Invoice Stone, chief funding officer at Glenview Belief Co., the rally in large tech is a matter of traders trying so as to add to portfolios after the selloff and in search of out shares with the best returns on capital and low quantities of debt.

“Persons are going buying and they're actually those that individuals will have a look at first,” he stated. “We’ve been telling shoppers to maneuver to high quality in case we go right into a recession. “Corporations with low debt and excessive returns on capital received’t endure as a lot.”

(Updates with closing costs all through.)

–With help from Thyagaraju Adinarayan and Phil Serafino.

Post a Comment