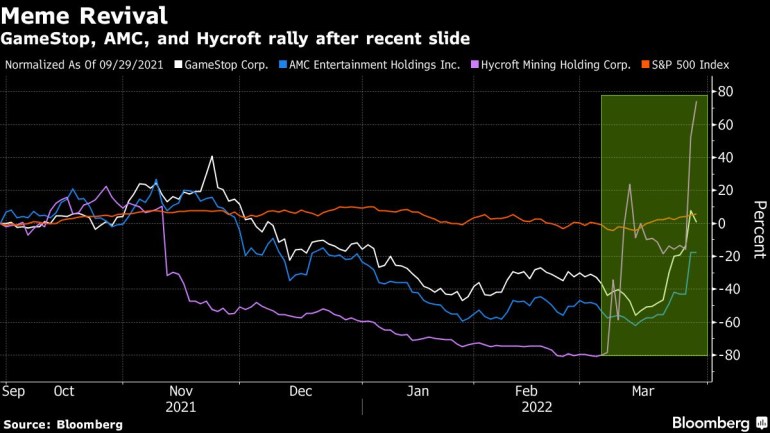

A basket of 37 so-called ‘meme shares’ has surged 45 % off a March backside, in keeping with Bloomberg.

Wall Road and particular person traders are as soon as once more dashing out and in of so-called meme shares because the urge for food for riskier property revives and volatility grips the group.

A basket of 37 meme shares tracked by Bloomberg has surged 45% off a March backside, rallying in 9 of 11 classes as tens of millions of shares change palms. A flurry of buying and selling exercise in out-of-the-money name choices — a well-liked buying and selling methodology amongst retail traders searching for to capitalize on speedy beneficial properties in a person inventory — have helped gasoline the most recent swings.

The decide up in that choices quantity “means that essentially the most speculative retail crowd on WallStreetBets and comparable is chasing the rebound aggressively,” mentioned Giacomo Pierantoni at Vanda Securities, which tracks retail-trading flows.

Meme shares noticed a pick-up in retail-investor demand on Monday, Vanda information confirmed, with AMC Leisure Holdings Inc. and GameStop Corp. seeing the biggest stream of particular person investor cash in months as each surged greater. Retail merchants snapped up $48.1 million in AMC shares Monday, bringing internet purchases over the previous week to $102.7 million, whereas GameStop noticed a $2.4 million influx, essentially the most since January, in keeping with Vanda.

The vendor of video-games and the movie-theater agency each closed on Monday at their highest degree in no less than three months, with AMC extending the achieve Tuesday and GameStop giving again a sliver of the rise. Whereas eye-catching, the latest rallies in meme shares pales compared to rallies seen in 2021, when shares equivalent to GameStop almost tripled in a single morning.

Nonetheless, the shares’ enchantment — and the buying and selling volatility surrounding the memes — isn't over but, in keeping with Ed Moya, senior market strategist at Oanda.

“A number of the favourite meme shares, AMC and GameStop have long-term visions that embrace betting on gold mines and crypto,” he mentioned in a message.

AMC gained some 1.9% Tuesday, a modest transfer in contrast with the 45% advance Monday. However Hycroft Mining Holding Corp., the gold miner during which AMC purchased a 22% stake earlier this month, jumped 11% after rallying 81% on Monday.

Quick overlaying from institutional traders could have boosted the latest surge, analysts mentioned, given retail traders’ contrarian buying and selling strategy, which often pitches them towards brief sellers. Practically one-quarter of GameStop shares out there for buying and selling are presently offered brief, in keeping with information from analytics agency S3 Companions, whereas AMC’s brief curiosity sits at roughly 21%.

“In a bullish market, skilled traders wouldn't attempt to brief these shares once more,” Vanda’s Pierantoni mentioned. “However on this bearish atmosphere/excessive vol regime, it is going to be tougher to see a melt-up much like what we had in Q1 2021.”

(Updates share motion all through.)

Post a Comment